Reversing inequality at the bottom: The role of the minimum wage

There are many factors affecting the growth in wage inequality in the United States over the past four decades. When it comes to workers on the bottom rungs of the income ladder, one important factor is the minimum wage.

The federal minimum wage reached its high-water mark in 1968, when it stood at $9.59 per hour in 2014 dollars, declining to a still-respectable $8.59 by 1979. During the 1980s, however, the real (inflation-adjusted) minimum wage declined substantially. And over the past 20 years, the minimum wage has largely treaded water, reaching a historical low of $6.07 per hour in 2006 just before the last federal increase in 2009. The minimum wage now stands at $7.25 per hour in today’s dollars.

The failure of the minimum wage to keep up with inflation means that, for workers earning the minimum wage, each hour of labor purchases less goods and services today than it did in the past.

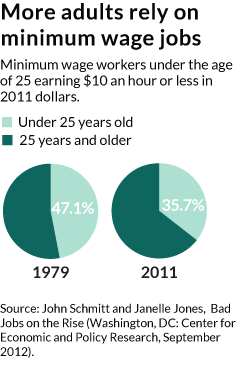

Minimum wage workers are not only (contrary to popular belief) teenagers and young adults whose low wages are supplemented by their families. In fact, between 1979 and 2011, the share of low-wage workers—defined as those with wages of $10 or less in 2011 dollars—under the age of 25 years of age fell to 35.7 percent from 47.1 percent.1 Instead, minimum wage workers are increasingly adults who must rely exclusively on their meager earnings to support basic household consumption. The decline in the value of the minimum wage affects female workers in particular, as they tend to be paid lower wages.

Low minimum wages are also problematic when they deviate too far from the median wage because that means minimum-wage earners are falling farther behind

on the income ladder. This is why economists often use the ratio of the minimum to the median wage. The so-called 50/10 wage gap—the median wage earner compared to those with earnings in the bottom 10 percent of the income ladder—captures this type of wage inequality over time. Since 1979, around a third of the changes in the 50/10 wage gap have been driven by changes in the minimum wage.

There are two main reasons to pay attention to this measure. First, a comparison of the minimum wage to the median offers us a guide to how many workers are affected by a particular minimum wage increase, and what level of minimum wage the labor market can bear. When this ratio is low—say around 0.2—the policy is not raising wages of many workers. In contrast, a high ratio—say around 0.8—indicates a highly interventionist policy where the minimum wage is dramatically compressing differences in wages for nearly half the workforce.

Second, the median wage provides a reference point for judging what is a reasonable minimum wage level. No one expects that the minimum wage should be set equal to the median wage, but fairness concerns matter when the minimum wage falls below say, one-fourth or one-fifth of the median wage.2

A natural target is to set the federal minimum wage to half of the median wage for full-time workers. This target has important precedence historically in the United States. In the 1960s, this ratio was 51 percent, reaching a high of 55 percent in 1968. Averaged over the 1960–1979 period, the ratio stood at 48 percent. Today, the ratio stands at 38 percent. Raising the federal minimum wage to around $10/hour would restore the value of the minimum to around half of the median full-time wage, yet efforts at raising the minimum wage have largely stalled in a deeply divided Congress despite widespread political support around the country.

This federal inaction has led to a flurry of activities at the state and local level. States have stepped in during periods with a stagnant federal minimum wage in the past, especially the 2000s, but for the first time in U.S. history we have many major cities establishing citywide minimum wages for all (or most) private-sector workers. The growing list of cities with such a policy now includes Albuquerque, Chicago, San Francisco, San Diego, San Jose, Santa Fe, Seattle, and Washington, DC. Other cities such as Los Angeles and New York are actively exploring possibilities.

This push to increase minimum wages in big cities coincides with organizing by workers in fast-food chains in major metro areas. The target minimum wage in most of these areas is substantially higher in nominal (non-inflation-adjusted) value— with $15/hour a focal point for these campaigns. The confluence of these factors raises the possibility of substantially altering wage standards in the U.S. labor market.

How should we think about these sizable increases in the minimum wage? First, we should be careful not to overstate the size of the increases or the levels of the minimum wages because the cost of living and overall wage levels vary tremendously by region. Setting the minimum wage to half the full-time median wage would produce $10/hour policy nationally, but much higher figures in major metro areas such as Washington, DC ($13.51), San Francisco ($13.37), Boston ($12.85), New York ($12.25), and Seattle ($11.85).

Moreover, these higher nominal wages are usually phased in gradually. In Seattle, the hourly minimum wage will eventually rise to around $14 in 2014 dollars. This constitutes around 59 percent of the median full-time wage in that metro area, which is certainly higher than historical standards but not outlandishly so.

So what we do know about the impact of minimum wages over the past few decades and the importance of particular channels for the higher, local wage standards? First, most careful recent work points to relatively small impact on employment—be it for sectors such as restaurants or retail or for groups such as teens.3 As a result of wage increases and small impact on employment, family incomes rise at the bottom. A 10 percent increase in the minimum would reduce the poverty rate among the non-elderly population by around 2 percent, and generally raises family incomes for the bottom 20 percent of the family income distribution.4

It is possible that the much larger increases in minimum wage may induce greater substitution of low-skilled labor with automation, or with fewer but more high-skilled workers? If this is true then we would expect evidence of growing “disemployment” (workers out of a job due to lack of skills or education) from these higher city-wide wage standards. Yet recent research also identifies some additional benefits that may be more important than larger wage increases. A growing body of research shows that while the impact on employment stock is small, there are larger reductions in employment flows or turnover.5 The reduction in turnover provides additional evidence that search frictions in the low-wage labor market are quantitatively important and offer some clues as to the way cost increases may be absorbed.

Given the cost of recruiting and training new workers, for example, reduction in turnover can be expected to offset about a fifth of the labor-cost increases associated with minimum wage hikes in this range. I think the large city wide increases will provide us with some additional evidence on this topic. In particular, I believe it should be possible to assess whether the lower turnover regimes lead to substantially different training policies as would be predicted by some models incorporating “search friction”—things that prevent or make it more difficult for workers to find the kind of jobs they want.6 Moreover, it will be interesting to see whether change comes from the extensive margin (growth in high-training/low-turnover firms) or the intensive margin (change within firms).

The nature of high-cost metro areas means that a substantially higher minimum wage may allow more lower-wage workers to live closer to their place of work (inside the city) and reduce commute time. The labor-supply effect from this “in-migration” also can reduce recruitment costs and improve the quality of the service work force.

These additional channels will be useful to keep in mind in future research. Evidence also suggests that, in part, cost increases associated with a higher minimum wage are passed on to customers as price increases, especially for industries that employ high levels of low-wage labor. The best evidence suggests that a 10 percent increase in minimum wage would raise fast food prices by around 0.7 percent.7 There are reasons to believe that the higher income customers inside major cities are better able to absorb price increases without cutting back on demand. Limited evidence from San Francisco tends to confirm this observation.8

Finally, there is some evidence that low-wage workers substantially increase consumption in response to wage hikes.9 Daniel Aaronson and Eric French at the Federal Reserve argue that the higher marginal propensity to consume among low-wage workers is likely to lead to some short-term increases in economic growth from a minimum wage increase.10 My reading of the evidence is that it is somewhat difficult to accurately assess the importance of this channel, in part because the relatively small number of minimum wage workers makes any aggregate demand effect fairly small. But I do think that the size of increases and possible in-migration of low-wage workers into urban areas may increase the local demand impact of a city wage standard.

Minimum wage policies are a powerful lever for affecting wage inequality in the bottom half of the labor market. Modest increases in minimum wages can raise the bottom wage, and family incomes, without substantially affecting employment. But minimum wages are limited in their reach, and cannot be expected to solve all our problems when it comes to wage inequality. At the same time, the much higher wage standards being implemented in some of the cities offer the possibility of taking this policy “to scale.”

Along with this greater promise, however, come added risks. The reality is that we do not know very well how these policies will affect the local economy. Future researchers would do well to utilize the careful identification strategies that have been the hallmark of recent minimum wage research to study these high city wide minimum wage increases. Doing so will deepen our understanding of the functioning of the low-wage labor market, and help us gauge the proper scope of this important public policy.

End Notes

1. John Schmitt and Janelle Jones, Bad Jobs on the Rise (Washington, DC: Center for Economic and Policy Research, September 2012), http://www.cepr.net/documents/publications/bad-jobs-2012-09.pdf.

2. David Autor, Alan Manning, and Christopher L. Smith, The Contribution of the Minimum Wage to U.S. Wage Inequality over Three Decades: A Reassessment, Working Paper (Cambridge, MA: MIT, February 2014), http://economics.mit.edu/files/3279.

3. Arindrajit Dube, T. William Lester, and Michael Reich, “Minimum Wage Effects Across State Borders: Estimates Using Contiguous Counties,” Review of Economics and Statistics 92, no. 4 (July 7, 2010): 945–64, doi:10.1162/REST_a_00039. Arindrajit Dube, T. William Lester, and Michael Reich, Minimum Wage Shocks, Employment Flows and Labor Market Frictions (Amherst, MA, 2013), http://www.irle.berkeley.edu/workingpapers/149-13.pdf. Sylvia A. Allegretto, Arindrajit Dube, and Michael Reich, “Do Minimum Wages Really Reduce Teen Employment? Accounting for Heterogeneity and Selectivity in State Panel Data,” Industrial Relations: A Journal of Economy and Society 50, no. 2 (April 1, 2011): 205–40, doi:10.1111/j.1468-232X.2011.00634.x.

4. Arindrajit Dube, Minimum Wages and the Distribution of Family Incomes, Working Paper (Amherst, MA, 2014), https://dl.dropboxusercontent.com/u/15038936/Dube_MinimumWagesFamilyIncomes.pdf. Sylvia Allegretto et al., Credible Research Designs for Minimum Wage Studies, Discussion Paper, IZA Discussion Paper (Bonn, Germany: Institute for the Study of Labor, September 2013), http://ftp.iza.org/dp7638.pdf.

5. Dube, Lester, and Reich, Minimum Wage Shocks, Employment Flows and Labor Market Frictions. Pierre Brochu and David A. Green, “The Impact of Minimum Wages on Labour Market Transitions,” The Economic Journal 123, no. 573 (December 1, 2013): 1203–35, doi:10.1111/ecoj.12032.

6. Daron Acemoglu and Jorn-Steffen Pischke, “Why Do Firms Train? Theory and Evidence,” The Quarterly Journal of Economics 113, no. 1 (February 1, 1998): 79–119, doi:10.1162/003355398555531.

7. Daniel Aaronson, Eric French, and James MacDonald, “The Minimum Wage, Restaurant Prices, and Labor Market Structure,” Journal of Human Resources 43, no. 3 (June 20, 2008): 688–720, doi:10.3368/jhr.43.3.688.

8. Arindrajit Dube, Suresh Naidu, and Michael Reich, “The Economic Effects of a Citywide Minimum Wage,” ILRReview 60, no. 4 (July 1, 2007): 522 – 543. Carrie H. Colla, William H. Dow, and Arindrajit Dube, The Labor Market Impact of Employer Health Benefit Mandates: Evidence from San Francisco’s Health Care Security Ordinance, Working Paper (National Bureau of Economic Research, July 2011), http://www.nber.org/papers/w17198.

9. Daniel Aaronson, Sumit Agarwal, and Eric French, “The Spending and Debt Response to Minimum Wage Hikes,” American Economic Review 102, no. 7 (December 2012): 3111–39, doi:10.1257/aer.102.7.3111.

10. Daniel Aaronson and Eric French, How Does a Federal Minimum Wage Hike Affect Aggregate Household Spending?, Chicago Fed Letter (Chicago: Federal Reserve Bank of Chicago, August 2013), http://www.chicagofed.org/digital_assets/publications/chicago_fed_letter/2013/cflaugust2013_313.pdf.