Overview

The U.S. system of corporate taxation is in desperate need of reform. Observers note that both the high statutory rate (35 percent) and the purported “worldwide” nature of our system place the U.S. system out of line with those of our trading partners. This characterization is misleading because it contradicts the underlying reality. Under the current U.S. corporate tax system, effective tax rates are far lower than statutory rates, and the foreign incomes of multinational firms often face a lighter burden than they would under the tax systems of our trading partners. A key goal of potential reforms to U.S. corporate taxation should be to better align the tax system’s stated features with its true characteristics.

Download FileCorporate Tax Report

Read the full PDF in your browser

Still, there are substantial reasons for discontent. Despite the high statutory rate, the U.S. tax system generates relatively little revenue for the federal government due to the narrowness of the corporate tax base, the preference in the U.S. tax code for non-corporate business structures, and the pervasive practice by multinational firms of shifting their profits overseas.1 The present system in particular creates a large incentive for corporations to book income in lightly taxed locations abroad, which in turn raises concerns about U.S. multinational corporations’ reluctance to repatriate profits to the United States. What’s more, the current corporate tax system encourages debt-financed investments relative to equity-financed investments, generating economic distortions and making the U.S. economy more vulnerable in times of economic stress.

Simply put, the U.S. corporate tax system is not fulfilling the aims of good tax policy. It is not efficient. It is not equitable. And it raises less revenue than it should. Still, this paper argues that the U.S. corporate income tax has an essential role to play in the larger U.S. tax system.

First, only a fraction of U.S. equity income is taxable at the individual level, so moving the corporate tax burden to individual shareholders, as suggested by some experts, is hardly a panacea. Such a move would require either a wholesale rethinking of U.S. tax preferences or large revenue loss. Second, the corporate tax is an important source of revenue, both in its own right, and as a backstop for the individual tax. Due to the increased share of corporate profits to gross domestic product and the increased share of capital income in national income, robust methods of capital taxation are important for revenue needs.

Third, capital taxation is no more inefficient than labor taxation, once you take into account more realistic models of optimal tax theory as well as the possibility that such taxes may fall on so-called “excess” or “monopoly” profits known as rents. Fourth, the corporate tax enhances the progressivity of our tax system, since it falls more heavily on capital income or rents than on labor income, and these sources of income are far more concentrated than labor income. While some minority portion of the corporate tax may burden workers, the corporate tax burdens workers less than most alternative taxes. In a time of dramatically increasing income inequality, progressivity is an important policy objective.

This paper builds the case for a robust corporate tax, focusing on the revenue needs of the federal government, the role of the corporate tax in an efficient and progressive tax system, and the importance of the corporate tax in tax administration. The paper closes with the policy implications of this analysis, including a set of reforms that are briefly summarized here.

Harmonize the tax treatment of different types of income and investment by:

- Reducing the tax preference toward debt-financed investment and toward certain types of investment

- Reducing the tax preference toward pass-through business income by non-corporate business structures

- Treating capital and labor income uniformly for tax purposes

Take steps to protect the corporate tax base from profit-shifting to low-tax countries by:

- Taking helpful incremental steps including a minimum tax that would currently tax foreign income earned in low-tax countries, tougher “earnings-stripping” rules, and anti-corporate inversion measures

- Enacting more fundamental reforms such as worldwide corporate tax consolidation or a so-called formulary apportionment that could update the corporate tax system to make it more suited to a globally integrated economy

In short, the case for a healthy corporate tax is clear, and there are several well-understood policy reforms that would dramatically improve the functioning of the corporate tax system. Policymakers need only the political will to move forward.

The U.S. corporate tax and government revenue

Recent trends in corporate tax revenue

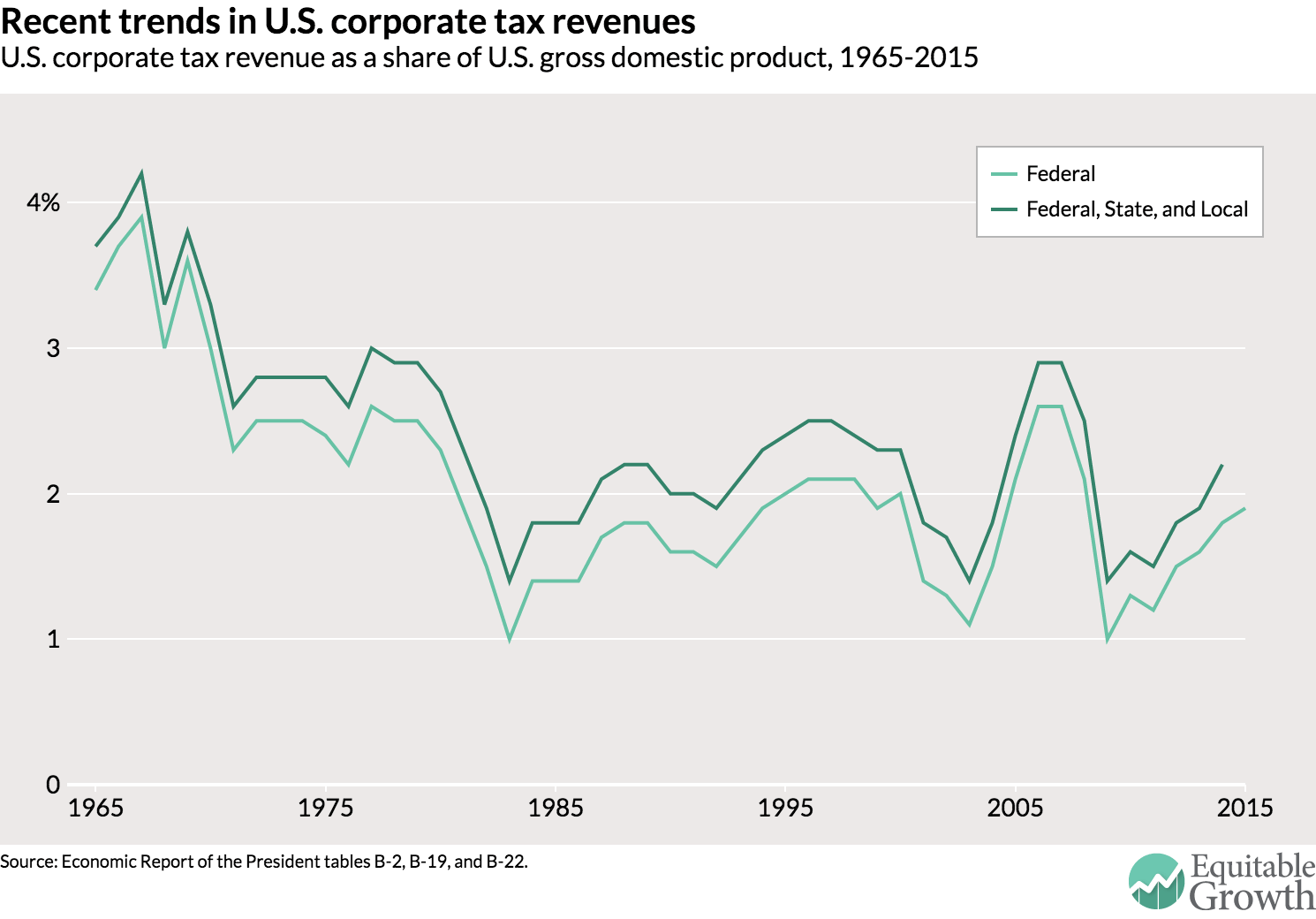

The U.S. corporate tax today accounts for an important part of the federal government’s revenues, despite problems associated with profit shifting and corporate tax base erosion. At the federal level, the corporate tax accounts for about 10 percent of all government revenue in recent years.2 The level of corporate tax revenue as a share of gross domestic product is about half of what it was 50 years ago, for both the federal government and the combined federal, state, and local governments. Since about 1980, however, corporate revenues have stabilized as a share of GDP, though they still fluctuate cyclically with the overall economy, falling during recessions. (See Figure 1.)

Figure 1

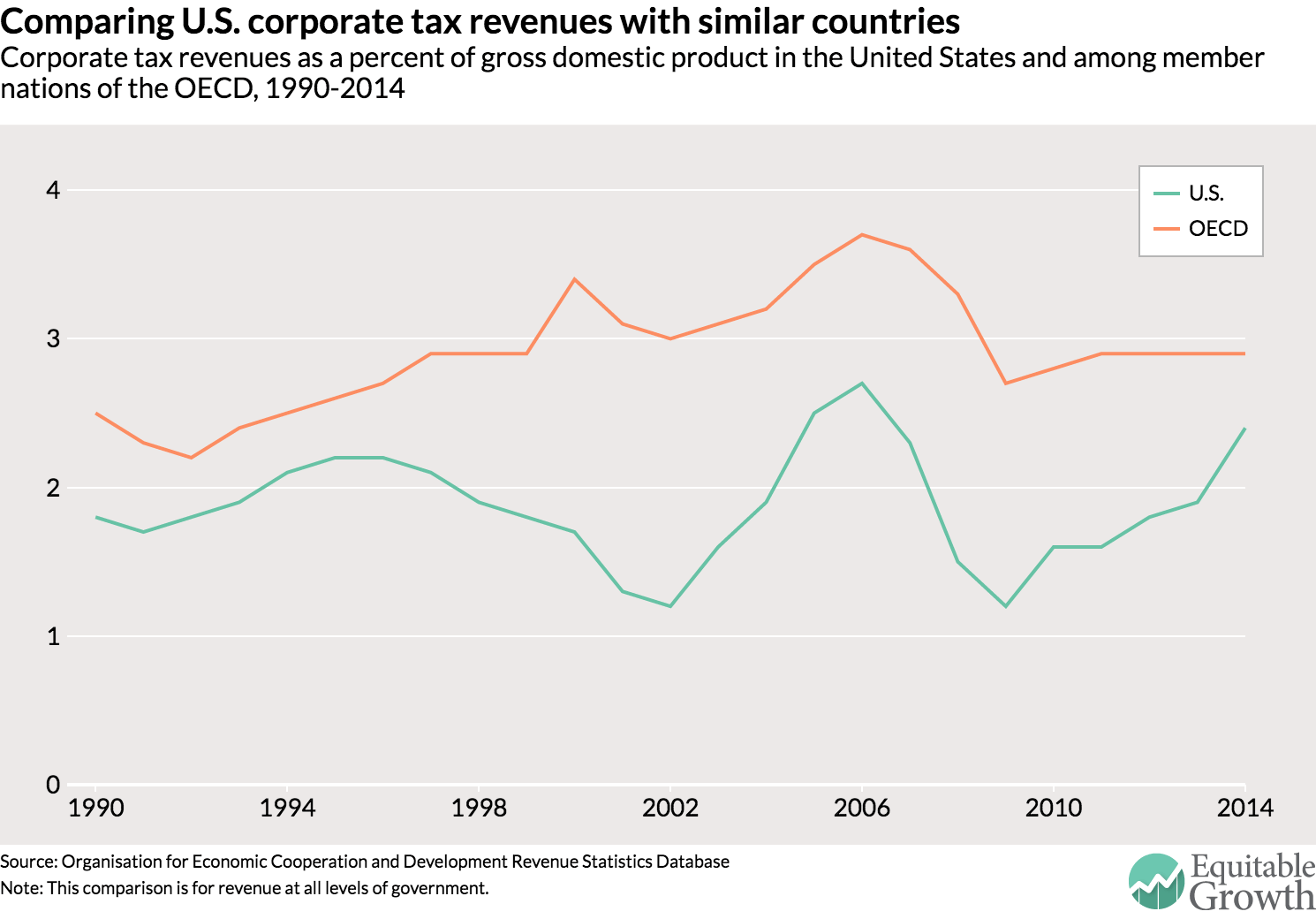

Despite a generally higher statutory tax rate of 35 percent, the U.S. government raises less revenue from its corporate tax as a share of GDP than that of the 35 developed and advanced developing member nations of the Organisation of Economic Cooperation and Development. (See Figure 2.) This difference is due to a combination of factors including a more narrow U.S. corporate tax base, profit shifting by multinational corporations from the United States toward countries with lower corporate tax rates, and the large and increasing share of U.S. business activity being booked in the unincorporated pass-through sector of business organizations.3

Figure 2

Forthcoming research in the National Tax Journal estimates that profit shifting is reducing U.S. corporate tax revenues by $77 billion to $111 billion in 2012, the last year for which complete data are available, with revenue losses likely exceeding $100 billion in 2016.4 As one indicator of the scale of profit-shifting activity, U.S. multinational firms have about $2 trillion of unrepatriated offshore earnings, over $1 trillion of which is in cash.

The increasingly higher share of unincorporated business entities in the United States today also contributes to lower business tax revenues. A recent working paper from the National Bureau of Economic Research—using data from the U.S. Internal Revenue Service—estimates that if U.S. business income had been earned with the same share of incorporation in 2011 as in 1980, business tax revenue would have been $100 billion higher.5

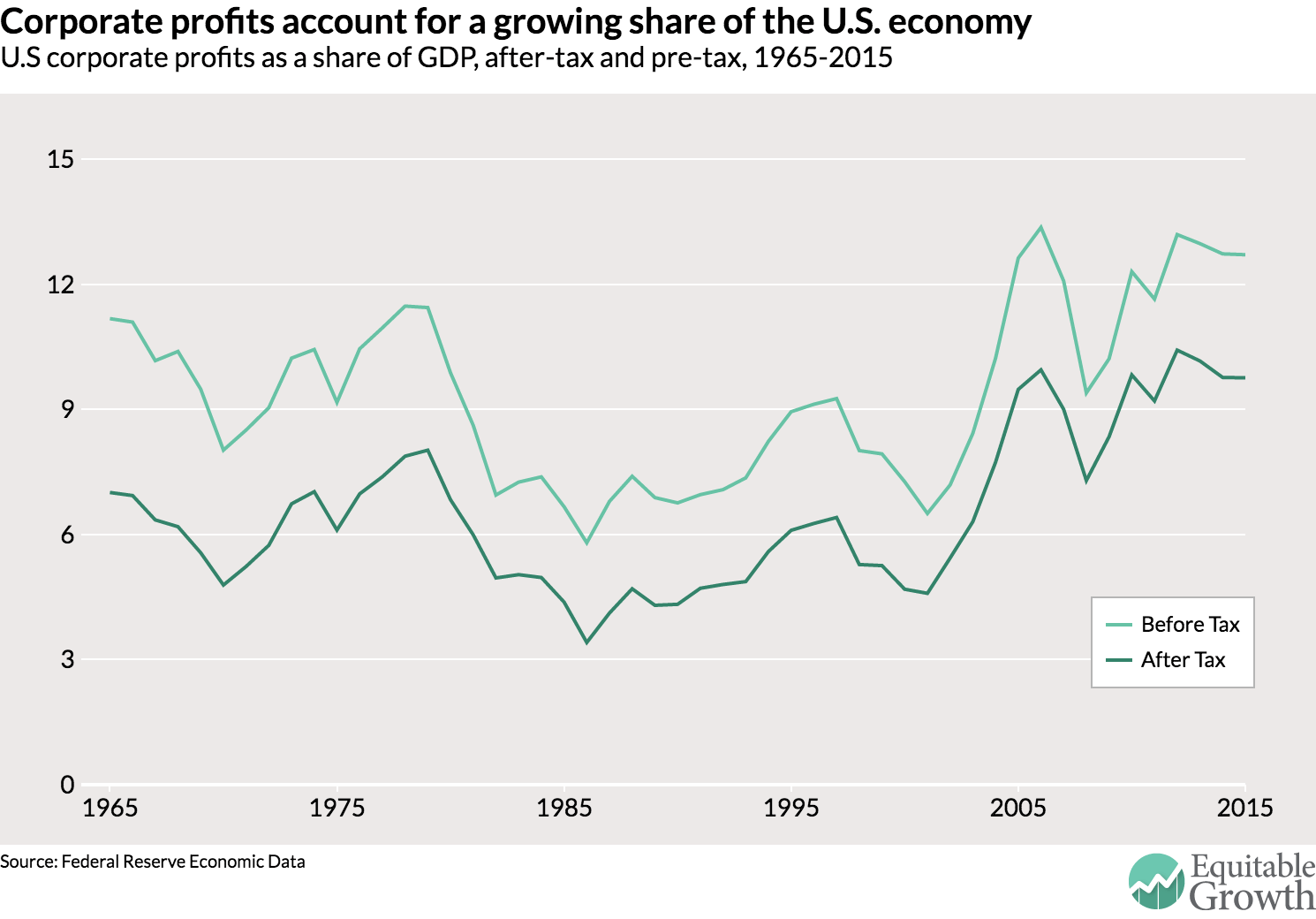

Recent trends in corporate profits

Some economists and tax experts argue that the relative stability of U.S. corporate tax revenues in recent years indicates that profit shifting and base narrowing is not an increasing problem. Yet it is important to remember that this stability has occurred in the context of rising corporate profits and a falling share of wages and salaries, or labor income, in national income. In the United States, corporate profits have been an increasing share of GDP in recent decades. In recent years, corporate profits of U.S. firms are higher as a share of GDP than they have been at any point in the last 50 years, either in before-tax or after-tax terms. Since 1980, corporate profits after tax have increased 4 percentage points, from about 6 percent of GDP to about 10 percent of GDP, while corporate profits before-tax have increased about 3 percentage points over the same period, from about 10 percent of GDP to about 13 percent of GDP. (See Figure 3.)

Figure 3

The capital share of income

It was long assumed by economists that the relative share of labor and capital in national income was constant. But one important feature of modern economies is the declining share of labor income relative to capital income and profits. For this reason, the importance of taxing capital from the standpoint of government revenues has increased in recent decades.6

Several data sources confirm that the labor share of income is shrinking relative to the capital share. A recent report by the Federal Reserve Bank of Cleveland examines these trends in the United States, noting that three different sources confirm the declining labor share: data from the U.S. Congressional Budget Office, the U.S. Bureau of Labor Statistics, and the U.S. Bureau of Economic Analysis.7

This trend also is observed in many other countries. A recent study by the International Labor Organization and the OECD describes the general pattern of these findings:

The OECD in 2012 has observed, for example, that over the period from 1990 to 2009, the share of labour compensation in national income declined in 26 out of 30 advanced countries for which data were available, and calculated that the median (adjusted) labour share of national income across these countries fell from 66.1 per cent to 61.7 per cent. A more recent OECD calculation finds that the average adjusted labour share in G20 countries went down by about 0.3 percentage points per year between 1980 and the late 2000s. Similar downward trends have been observed by other international institutions.8

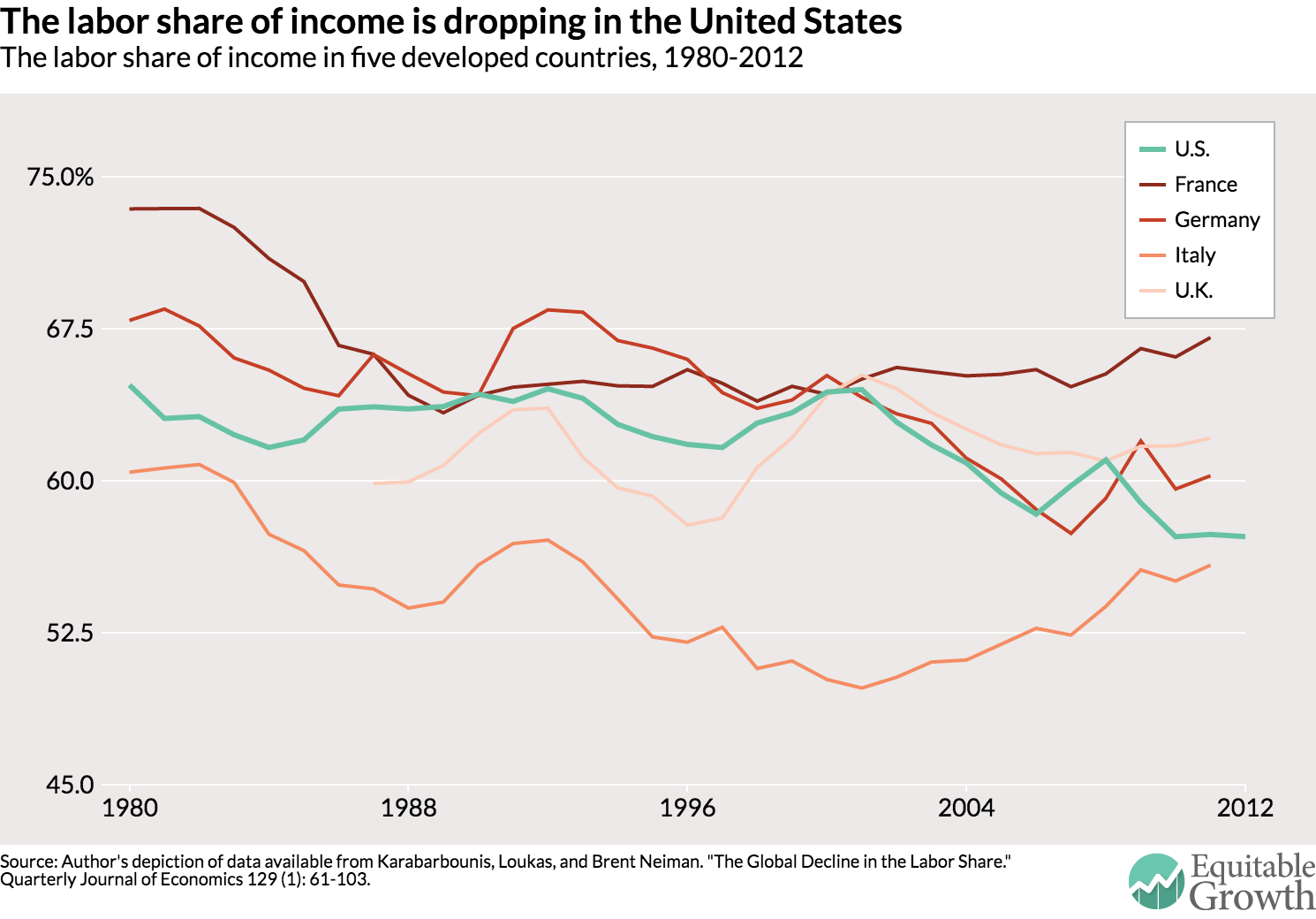

In a recent National Bureau of Economic Research report by Loukas Karabarbounis at the Federal Reserve Bank of Minneapolis and Brent Neiman at the University of Chicago, the two economists analyze the declining labor share, focusing on the corporate sector.9 Their data on the corporate labor share for the United States show that the U.S. share declines by 8 percentage points between 1980 and 2012. (See Figure 4.)

Figure 4

Aside from the United Kingdom, Figure 4 shows that the other countries also posted large declines in their labor share of income. This same downward trend is visible among the less developed member nations of the Group of 20 with relatively complete data. India, China, South Africa, and Mexico all show declines over this period, with Brazil as an exception.10

Of course, accounting for depreciation—the decline in the value of an asset over time—also affects the relative share of labor and capital in national income. For the United States, Benjamin Bridgman at the U.S. Bureau of Economic Analysis finds that properly accounting for depreciation may reduce the amount by which the labor share is falling, from 9 percent to 6 percent, using BEA data over the period 1975 to 2011.11 Karabarbounis and Neiman use the concept of net labor shares to account for the effect of depreciation on the labor share. They find that net labor shares move in the same direction as gross labor shares between 1975 and 2011.12 And in a recent paper by Michael Elsby at the University of Edinburgh, Bart Hobijn at the Federal Reserve Bank of San Francisco, and Aysegul Sahin at the Federal Reserve Bank of New York, the three economists note that the decline of the labor share may be overstated due to measurement issues surrounding the self-employed, but that the labor share is declining nonetheless.13

There are myriad difficulties, of course, associated with data classification when calculating the relative share of labor and capital in national income. There is also the overarching question of whether one can even hope to accurately distinguish labor from capital income. As law professor Victor Fleischer at the University of San Diego argues, much inequality is driven by what he refers to as “alpha” income—income derived from entrepreneurship or the risky returns to human capital.14 “Alpha” income may have elements of both capital and labor, though some of it is taxed as capital. Examples include founders’ stock, carried interest, and partnership equity.15

There is widespread acknowledgement that the labor share of income in an economy is countercyclical, meaning that it rises during recessions, so there was some recovery in the labor share of national income in the wake of the Great Recession of 2008-2009. This consideration, however, does not offset the generally robust evidence of a secular decline in the labor share in many countries in recent decades.

Note that while a declining labor share may contribute to inequality, since capital income is more concentrated than labor income, the labor share itself is not a measure of inequality. For instance, rising pay among chief executives may increase the labor share even as CEO pay increases inequality in society as a whole. To consider inequality, one needs to consider the distribution of both labor income and capital income.

In summary, in an environment where both the capital share of income and corporate profits are rising, it is important to preserve corporate taxes on capital and profits as sources of revenue. While U.S. corporate taxes have been roughly stable as a share of GDP in recent years, that stability masks substantial erosion of the corporate tax base.

The U.S. corporate tax and efficiency

Taxing capital for efficiency

While capital taxation can be an important source of revenue and progressivity, there may be concern that capital taxation is not efficient.16 Indeed, there are papers in the public finance literature that suggest the optimal capital tax rate is zero. The logic behind these models is that capital taxation will reduce the future stock of capital and the growth rate of the economy. The zero tax rate result is due to the highly distortionary nature of capital taxes over time.17

The seminal research in this area include papers by economists Kenneth Judd (now at the Hoover Institution), Christophe Chalmey (now at Boston University), and Anthony Atkinson (now at Oxford University) and Joseph Stiglitz (now at Columbia University).18 Yet aspects of these canonical models are highly unrealistic, including economic assumptions such as infinitely lived households, perfect foresight, perfect capital markets, and so on.

More recent theoretical work suggests an important role for positive capital taxes, often at rates similar to what we observe in practice. In fact, two of the most prominent contributors to this early literature, Atkinson and Stiglitz, now argue strongly for increased levels of capital taxation.19 As they note in a new preface to their co-authored classic text, “Lectures in Public Economics:”

One of the striking—and disquieting—results of Atkinson and Stiglitz (1976)… was that there should be no taxation of capital. But once one recognizes differences in the ability to obtain returns on capital, the result no longer holds. There are other reasons…[as well]… For instance, if some of what is recorded as a return to capital is in fact a monopoly rent… it should be taxed—and indeed taxed at a very high rate.20

Similarly, economists Juan Carlos Conesa at Stonybrook University, Sagiri Kitao at Keio University, and Dirk Krueger at the University of Pennsylvania take into account incomplete capital markets and an explicit life-cycle structure to savings decisions. Their model generates an implied optimal capital tax rate of 36 percent, and the nature of their result is robust to changes in key economic parameters.21 Also, Thomas Piketty at the Paris School of Economics and Emmanuael Saez at the University of California-Berkeley employ a model with an explicit role for inheritance, noting that bequest taxation is optimal when labor income is no longer the unique determinant of lifetime incomes. Their research finds that the optimal inheritance tax is about 50 percent to 60 percent. Together with imperfect capital markets and uninsurable idiosyncratic shocks to rates of return, their model also implies an optimal capital tax at a rate that may exceed the optimal labor income tax.22

Emmanuel Farhi at Harvard University, Christopher Sleet and Sevin Yeltekin at Carnegie Mellon University, and Ivan Werning at the Massachusetts Institute of Technology also suggest a political economy rationale for positive capital taxation. In their model, large degrees of unchecked wealth inequality generate political demands for extreme expropriation capital taxes.23 These extreme outcomes can be avoided, however, through more moderate levels of capital taxation over time, and an optimal capital tax schedule that is progressive. In other words, moderate capital taxation, while distortionary, defuses political pressures for much more distortionary policies.

Other theoretical rationale also can generate an important role for capital taxation at positive rates. For instance, there are likely to be positive correlations between earning opportunities and savings propensities, and these correlations can render capital taxation efficient. Borrowing constraints and the uncertainty of future earnings can also generate a useful role for capital taxation.24

These newer models have many attractive features. First, they match the reality on the ground far more than the earlier models that emphasized the optimality of zero tax rates on capital. As Piketty and Saez note, the models of that prior literature imply that economists should support the elimination of all inheritance taxes, property taxes, corporate profit taxes, and taxes on dividends and capital gains. Yet most economists would not recommend such a dramatic agenda, and most countries levy substantial taxes on capital, often 8 percent to 9 percent of GDP in wealthy countries.25

Second, in contrast to the implications of the earlier economics literature prescribing zero taxes on capital, the latest research finds that capital taxes do not appear to have large effects on the capital stock or on economic growth. Despite a wide variety of policy experiments on capital taxes, there remains little empirical evidence of large growth effects from lower taxes on capital. A recent study by Harvard University’s Simeon Djankov and his co-authors at Harvard and the World Bank considers the impact of corporate taxation on investment using international data, but their analysis had mixed results.26 Indeed, as noted by Piketty and Saez, capital to output ratios have been remarkably stable over time despite changes in tax policy.27

Third, there is little evidence that savings rates are sufficiently sensitive to the parameters of tax policy to generate the results expected from a zero optimal capital tax. Evidence from the behavioral economics literature suggests that household savings decisions are heavily influenced by psychological elements and minor transaction costs, indicating there is little evidence in support of the perfect foresight models. Also, bequests are left for many reasons, such as accidental and altruistic motivations, and these sorts of motivations also interfere with the results predicted by zero capital tax optimality.

Finally, as Atkinson and Stiglitz recognize, rents (excess profits) are an important part of the corporate tax base. While capital income is in part a reward for postponing consumption, excess profits can be taxed without adverse efficiency concerns. Indeed, it may be optimal to tax away rents as much as possible since taxes on rents are non-distortionary.28 Preliminary work by U.S. Department of the Treasury economists John McClelland and Elena Patel—using IRS data on corporate tax returns—indicates that less than half of the corporate tax base represents the normal return to capital (the rest being rents), and the normal return share has been falling substantially in recent decades.29 Differences across industries are what we would expect, with intangibles-intensive industries such as information technology and pharmaceuticals having particularly low shares of normal returns. This indicates that excess profits are an increasingly important part of the corporate tax base.

Taxing capital: Corporations or individuals?

Taxing capital is important for the efficiency of the larger U.S. tax system, but in theory, this taxation need not occur at the level of the firm if individuals are taxed on their capital income as dividends and capital gains. Yet these forms of individual capital income are often taxed preferentially in the United States, if at all.

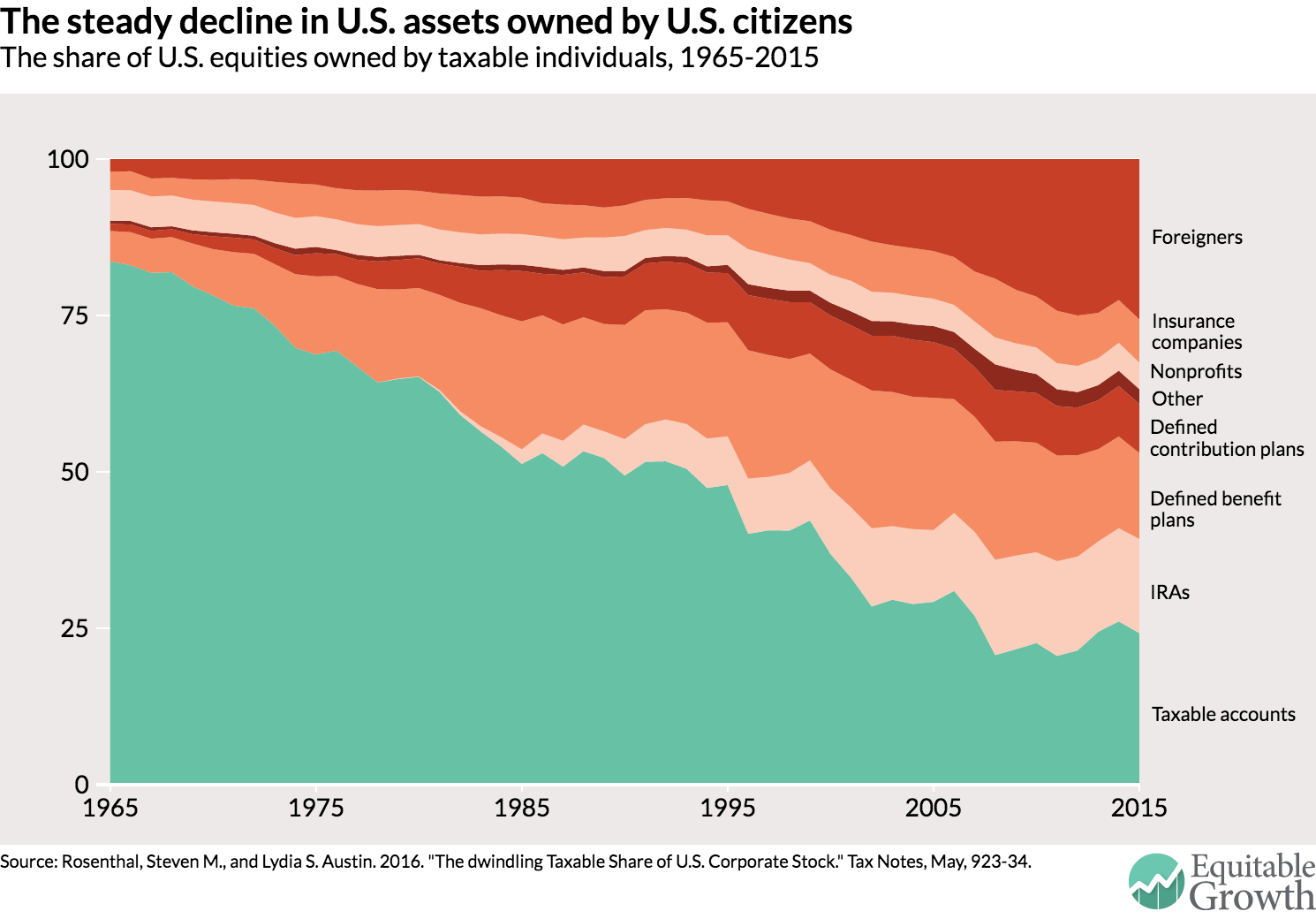

Indeed, without a corporate tax, much of the income of profitable firms would go untaxed in the United States since most corporate equity is held in tax-exempt form. New evidence suggests that perhaps as little as 24 percent of U.S. equities are held in accounts that are taxable by the U.S. government. Stephen Rosenthal and Lydia Austin at the non-profit Tax Policy Center in Washington, D.C. use Federal Reserve data to derive the share of U.S. equities owned by taxable U.S. individuals, finding that it has declined sharply in recent decades due to increasing foreign ownership and, even more importantly, because of the growth of untaxed accounts, particularly retirement savings plans and Individual Retirement Accounts.30 (See Figure 5.)

Figure 5

In addition, replacing corporate taxation with individual taxation would either worsen the lock-in problem for capital gains (since people will defer selling stock to allow gains to accrue untaxed) or necessitate mark-to-market taxation, where individuals are taxed on unrealized gains based on their present market value. Yet mark-to-market taxation would raise liquidity concerns (if people need to sell assets to pay taxes), and would make the tax base much more volatile because of market fluctuations.31

In practice, however, the issue is moot unless policymakers want to rethink the tax exemption of many types of investment income at the individual level. In the meantime, the corporate tax is an essential method for taxing capital.

The U.S. corporate tax and economic inequality

The greater concentration of capital income

Rising income inequality in the United States is indisputable; all data series indicate that the distribution of income has become much more concentrated in recent decades. U.S. Census Bureau survey data focus on wage and salary income earned on a regular basis, but the data do not include capital gains. Yet looking only at wage-and-salary income shows a dramatic increase in income inequality. The top 5 percent of households receive 16.5 percent of all national income in 1980 and 22.3 percent of that income in 2012. The mean income of the top 5 percent of income earners (in 2014 dollars) increased dramatically, from $190,000 in 1980 to $328,000 in 2012. In contrast, the mean income for the middle 20 percent of income earners was much less pronounced, increasing from $48,500 in 1980 to $52,800 in 2012.32

Measures that include more capital income show an even greater concentration of income at the top of earnings distribution. The Congressional Budget Office reports that the top 5 percent of households report 20 percent of all income in 1980, increasing to 30 percent in 2012. The U.S. Treasury reports that the top 5 percent of tax units (defined as an individual or married couple filing a tax return jointly, including dependents) report 24 percent of all national income in 1986 (the earliest year available), increasing to 37 percent in 2012.33

From @KClausing: Profit shifting and U.S. corporate tax policy reform https://t.co/vWDTcaXh13

— Equitable Growth (@equitablegrowth) May 25, 2016

Indeed, capital income is much more concentrated than labor income. Data from the Tax Policy Center for 2012 indicate that the top 5 percent of tax units report 68 percent of dividend income and 87 percent of long-term capital gains income.34 Scholars involved in the World Top Incomes Database project also find that the top 1 percent’s share of income in the United States is higher (and more volatile) if capital gains income is included.35

The U.S. Treasury also reports data on the top 400 taxpayers. This particularly small group of taxpayers reports 1.48 percent of total income in 2012, but 0.16 percent of total wage and salary income, 8.3 percent of total dividend income, and 12.3 percent of total capital gains income.36 The overall share of this tiny group has more than doubled since 1992 (when the data series begins). The wage-income share of the top 400 taxpayers has been flat but the capital-gains share has more than doubled, and the dividends share has more than quadrupled.

Who pays U.S. corporate taxes in a global economy?

Clearly capital income is more concentrated than labor income, but in order to consider the progressivity of the corporate tax one must also determine its incidence, or how much the tax falls on different groups. Who is burdened by the corporate tax? Does it fall on the normal return to capital? Or does it fall on shareholders who receive fewer supernormal profits due to the tax? Or instead is it shifted onto workers in the form of reduced wages?

These are challenging questions, both in theory and empirically. Many economists and tax experts assign the tax burden of the corporate tax across capital and labor based on estimates of likely magnitudes. The U.S. Treasury Department, for example, assigns 82 percent of the burden of the corporate tax to capital income and 18 percent to labor income, after assigning all supernormal (or excess) profits to capital income, and half of normal profits to labor and half to capital income. Under this method, the U.S. corporate tax is a very progressive tax, with the highest quintile paying 76 percent of the tax burden, and the top 1 percent paying 43 percent of the burden.37

The Tax Policy Center makes a similar distribution, assigning 80 percent of the burden of the corporate tax to capital and 20 percent to labor.38 The Congressional Budget Office allocates 75 percent of the corporate tax to capital and 25 percent to labor.39 The Joint Committee on Taxation makes similar assumptions in the long run, though in the short run it assigns the entire burden to capital.40

The literature on corporate tax incidence is extensive.41 Early models of corporate tax incidence indicated that the entire burden of the tax would fall on capital, but later work extended these models to the open economy, finding that more of the burden could fall on labor.42 In these models, capital mobility across countries may reduce the capital stock of high-tax countries, increasing it in low-tax countries. These changes in the capital stock affect the underlying marginal products of labor, thus reducing wages in high-tax countries where the capital stock is lower due to taxation. In a review of these models that calibrates them for likely magnitudes of key economic parameters, Jennifer Gravelle at the Congressional Budget Office finds that about 60 percent of the corporate tax burden would fall on capital and 40 percent on labor.43

Yet these simple theoretical models ignore many important features of the world that could affect the incidence of the corporate tax, including whether the tax has residence-based elements, how the tax affects debt-financed investments, the extent to which the tax falls on economic profits, and the effects of the tax on bargaining, among other considerations. Jane Gravelle and Thomas Hungerford of the Congressional Research Service note that residence elements could cause the tax to fall more heavily on capital, and that increases in the U.S. corporate tax could actually cause inflows of debt-financed capital due to U.S. corporate taxation since such investments are subsidized by the U.S. corporate tax system.44 And, as noted in the previous section of this paper, to the extent that the corporate tax falls on excess profits, it would not distort capital allocation but would fall on shareholders.45

The traditional open-economy incidence mechanism relies on capital mobility to change the capital stock that workers utilize, affecting wages by affecting the marginal product of labor. But there are other incidence mechanisms, including the effect of corporate taxes on bargaining between workers and their employers. The effects of corporate taxes on wages in bargaining models, however, are ambiguous since there are two key effects: Corporate taxes reduce the size of the pie to be bargained over, lowering wages, but they also reduce the sensitivity of the firm to wages due to the deductibility of wage payments.46 The latter effect tends to dominate so that wages should increase with corporate taxes.

Given the ambiguities of the essential theoretical mechanisms, the incidence of the corporate tax remains an empirical question, albeit a difficult one.47 Yet a careful analysis of the cross-country evidence indicates that there is no clear and persuasive link between corporate taxes and wages.A comprehensive review of the cross-country evidence on corporate tax incidence, using multiple source of both wage and tax data, and multiple methodologies—all with a comprehensive battery of robustness and sensitivity checks—shows that while there is a bit of evidence in some specifications that suggests corporate taxes may depress wages, the preponderance of evidence suggest no clear and persuasive link between corporate taxes and wages across OECD countries.48

What accounts for this finding? Several factors may be important. First, the theoretical mechanisms are based on simple models that do not account for important features of the corporate tax, including the tax-treatment of debt finance, residence components of the corporate tax, and the extent to which the tax falls on super-normal profits. Second, the international experience (and the resulting data) are limited, and it is possible that myriad other influences acting on the data make the true effect of corporate taxes on wages difficult to observe.

Third, it is likely that corporate taxes affect the ownership and financing patterns of capital stock more than the overall capital stock; corporations are mere intermediaries in global capital markets in which a wide assortment of investors with different tax treatments invest. Debt-financed investments, for example, are treated differently than equity-financed investments. Portfolio investment and direct investment also receive different tax treatments. It is indeed likely that some types of investment are discouraged by the corporate tax, but other types take their place.

Finally, it is possible that profit-shifting behavior by multinational corporations blunts any need to move the capital stock in response to corporate tax burdens. Evidence suggests that multinational corporations are adept at shifting the location of their profits toward lightly taxed jurisdictions, often with little or no commensurate economic presence. In 2012, for example, a majority of the gross foreign income of overseas affiliates of U.S.-based corporations was earned in just seven tax haven locations, yet these seven havens together hosted only 5 percent of the employment of these foreign affiliates.49

Another approach to answering the question about corporate tax incidence is to use more disaggregate data to consider how firm-bargaining mechanisms are affected by the corporate tax. Some economists refer to this bargaining channel as “direct” incidence while defining the capital-stock channel as “indirect” incidence, finding that the bargaining channel may cause some burden of the corporate tax to be passed to workers.50 But this research has its own challenges. For instance, it is not always possible to control for firm-specific effects, yet there may be firm-specific attributes that affect both tax payments and wages. Also, some of the most careful analyses use data from Germany, where the wage bargaining process may not be generalizable to the institutional environments of other countries, particularly the United States.51

Dynamic considerations are also important to model. It is important to remember that the domestic labor market is integrated across industries and firms. In the long run, it is likely that the incidence effects of corporate taxation will be affected by the mobility of workers from lower-wage industries and firms to higher-wage industries and firms. This consideration may reduce the policy applicability of these “direct” incidence findings.

A novel contribution to this line of inquiry comes from economist Juan Carlos Suarez Serrato at Duke University and Owen Zidar at the University of Chicago, who in a recent research paper consider corporate tax incidence within a model that includes spatial amenities. These mechanisms allow firm owners and land owners to bear taxes since there are location-specific amenities; firms are heterogeneously productive and monopolistically competitive. Suarez Serrato and Zidar find that workers bear about one third of the incidence of the corporate tax, with the rest falling on the owners of firms and land.52

Given the large range of empirical estimates, there is still substantial uncertainty regarding who bears the corporate tax. The international data indicate very little robust evidence linking corporate tax rates and wages. The more disaggregate data indicate more robust evidence of a link, but it may have less broad policy applicability. Yet, as the U.S. Treasury analysis shows, even if you assign half of the burden of the tax on normal returns to labor, and the other half (as well as the supernormal returns) to capital, then 82 percent of the corporate tax still falls on capital, and it is a very progressive tax. It is worth noting that most other major alternative tax instruments fall nearly entirely on labor, including the individual income tax and the payroll tax, which together account for 80 percent of U.S. federal revenue in 2014.53

There is in addition a political economy point about incidence that is worth bearing in mind. If the corporate tax falls on labor, why do managers and shareholders resist it so vehemently? Is it because they do not understand the true incidence of the corporate tax? That’s possible, but like others, I’d be inclined to wager that they understand their economic interests correctly.54

The U.S. corporate tax and tax administration

Tax administration is often neglected in economists’ discussions of ideal tax policy, but it is nonetheless essential. Concepts that may be ideal in theory may prove impossible to administer given the real-world features of the present U.S. tax system and the limits of politics, monitoring, and other considerations. The ideal design of a tax system must pay attention to compliance and enforcement costs.

In this sense as well, there are several pragmatic reasons for taxing capital. First, in practice, it can be hard to distinguish capital and labor income, particularly for high-income and/or self-employed individuals that have discretion regarding the form in which they receive their income. Indeed, there is evidence that shifting between the capital tax base and the labor tax base takes place in response to tax-rate differentials. In Finland, for example, research shows clear evidence of such tax-shifting behavior because capital income is taxed at a lower rate than labor income.55 Thus, a capital tax rate that is significantly lower than the labor tax rate runs the risk of depleting the labor income tax base through income shifting across tax bases. Also, as noted in the second section of this paper, savings propensities may be correlated with earnings abilities, which gives capital taxation a useful efficiency role.

Second, the corporate tax also plays an important role in protecting the individual income tax base. In particular, the corporate tax can become a tax shelter if the corporate rate falls much below the individual rate. In that event, high-income individuals could channel funds into corporations, retain earnings, and obtain lower tax rates than if they operated in non-corporate form. Using a simple calculation for corporate investments financed by equity and taxable at the individual level—and under the assumption that non-corporate business (pass-through) income would be taxed at the individual level at top labor income rates—the Congressional Research Service’s Gravelle and Hungerford compare tax rates for alternative organizational form. They find that a reduced corporate tax rate of 27 percent would provide sheltering opportunities for corporations that distribute less than 73 percent of their earnings.56

At present, under most assumptions, pass-through income is tax-preferred, which helps account for the growth in pass-through income.57 Indeed, the literature suggests that the choice of organizational form is likely to be sensitive to this relative tax treatment.58 While pass-through income is generally tax-preferred, the overall tax treatment of investment income depends on many key factors, including:

- Is pass-through business income taxed at labor or capital rates? Much pass-through income is taxed as labor income, but there are important exceptions, including founders’ stock, carried interest, and partnership equity. To the extent that pass-through income is taxed as capital, it furthers the tax preference for pass-through income.

- What fraction of corporate earnings is retained and what fraction is instead distributed as dividends? As corporations retain a higher share of earnings, this reduces the tax disincentive for earning income in corporate form.

- Can the tax base be eroded through profit-shifting activities? Multinational firms may lower the corporate tax burden on their earnings by shifting income abroad, which reduces the tax rate associated with corporate form in such cases.

- Is the investment debt-financed or equity-financed? Debt-financed investment is subsidized due to interest deductibility and accelerated depreciation, but equity investments are taxed more heavily. This is true regardless of organizational form.

- Is corporate investment taxable at the individual level? As noted in a previous section of this report, new evidence suggests that about three quarters of U.S. equity income goes untaxed at the individual level. This lowers tax burdens on many investments.

Thus, U.S. corporate income tax reform needs to be sensitive to the role of the corporate tax across many dimensions—as a revenue source, as an efficient tax, as part of a progressive tax system, and as an administrative feature of our tax code that interacts with other parts of the tax base.

Policy implications for the U.S. corporate income tax

As the above sections have made clear, the U.S. corporate income tax is an essential part of the U.S. tax system. That said, most observers agree that the U.S. corporate tax is overdue for a major reform. While the need for reform is clear, there remains substantial disagreement about how a reform should be designed. After describing problems with the current system, this section will discuss possible policy solutions, focusing on proposals that would support a robust role for the corporate tax in the larger tax system.

Problems with the current system

There are three types of intertwined problems with the U.S. corporate tax system. First, the U.S. corporate tax generates less revenue than one might expect relative to the size of the U.S. economy and relative to peer nations, particularly considering recent increases in corporate profits and the capital share of national income. U.S. corporate tax revenues are about 1 percent of GDP lower than those of peer nations, and they have not increased in line with increasing U.S. corporate profits.

Second, the U.S. corporate tax system is highly distortionary across many dimensions. There are several key areas of tax-induced bias in the system:

- Debt-financed investments are tax-preferred (and, in fact, often subsidized) relative to equity investments. This treatment increases the leverage of the U.S. economy and amplifies macroeconomic vulnerability in times of financial instability or recession.

- Pass-through income is generally tax-preferred relative to corporate income. This creates a tax-distortion to organizational form which generates large revenue losses since pass-through income is generally taxed at lower effective tax rates than C-corporation income.59

- Some types of investment receive relatively favorable tax treatment in comparison with other types of investment due to more favorable depreciation rules, tax treatment that favors the oil-and-gas sector, the production income deduction, and the greater ability of multinational firms (and, in particular, those that are intensive in intangible assets) to avoid paying the U.S. corporate tax through profit shifting abroad.

- Capital income is tax-favored relative to labor income for individuals. This provides a tax inducement for those with discretion, usually but not always high-income individuals, to distort the form in which their income is received.

Third, our system of taxing multinational corporations generates its own set of distortions and substantial tax base erosion. Specifically:

- Profit shifting by multinational firms is estimated to cost the U.S. government about $100 billion each year in lost corporate tax revenue at present. This problem has been steadily worsening in recent years.

- Our international tax system creates perverse incentives to earn income in low-tax countries and to avoid repatriating the income to the United States. Although our system purports to tax the worldwide income of U.S. multinational firms, allowing a credit for foreign taxes paid, U.S. tax is not due until income is repatriated.

- Multinational firms headquartered in the United States claim that they are at a competitive disadvantage relative to firms headquartered in other countries.

- There is an incentive for corporations to undertake corporate inversions in order to further profit shifting out of the U.S. tax base. A corporate inversion occurs when a U.S. company combines with a foreign company for the purpose of locating its residence in a foreign jurisdiction with a low corporate tax rate.

Reforms that would reduce distortion and protect the U.S. tax base

There are four ways the U.S. tax system could be reformed to reduce the distortions in the current system that lead to the problems presented above: harmonizing the tax treatment of debt- and equity-financed investments; harmonizing the tax treatment of different forms of business organizations; harmonizing the tax treatment of different types of investments; and harmonizing the tax treatment of labor and capital income. All four steps would make the U.S. tax system more effective and efficient. This section will briefly examine each of these reforms in turn.

Harmonize the tax treatment of debt-financed investments and equity-financed investments

At present, debt-financed investments are tax-preferred due to the deductibility of interest payments; there is no corresponding deduction for equity-financed investment. Policymakers could harmonize tax treatment by either lowering the tax burden for equity-financed investments or raising the tax burden for debt-financed investments.60

Harmonize the treatment of different forms of business operations

Increased capital tax rates (discussed below) would reduce the preference toward some types of pass-through income, including carried interest, founders’ stock, and partnership equity. Yet, more generally, tax reform should aim to reduce distortions due to tax preferences across organizational forms.

Present tax rates generally favor pass-through income even if it is earned as labor income in cases where a large share of income is distributed to shareholders. The top U.S. personal labor income tax rate of 39.6 percent is generally less than the tax rate that would apply if all income were taxed at the statutory corporate rate of 35 percent and then distributed as dividends. But when most of the income is retained, the corporate form may be preferable in some cases. For taxable investors, the calculation of the tax-neutral tax rates is complicated by various factors, including what share of corporate income is distributed as dividends, whether pass-through income is taxed as labor or capital (if rates are not harmonized), and how organizational form itself affects tax avoidance opportunities.

It would be sensible to base pass-through status on the size of the business, treating large pass-through firms more like C corporations. There remains concern about potential “double” taxation if corporate income is taxed at both the individual and corporate level. It is important to remember, however, that the overall level of tax matters far more than the number of taxes. Most taxpayers, for example, would prefer two 1-percent taxes to a single 10 percent tax, abstracting from any compliance cost differences. Thus, policy-makers should focus on the overall tax burden, not the number of times something is taxed.

Some economists and tax experts argue for moving more of the capital tax burden to the individual level, since corporations may be more able to avoid taxation.61 Yet even though evidence about individual tax avoidance is less plentiful, such avoidance is likely far from trivial.62 In addition, as recent research demonstrates, the vast majority of U.S. equity income is not taxed at the individual level.63 One way to address both of these concerns is to have the individual level of tax withheld at the corporate level for all corporate investors including non-taxable entities.

Also, complex partnership structures often result in large quantities of partnership income that cannot be ultimately traced to a beneficial owner, generating the concern that firms are minimizing tax through opaque organizational forms.64 One possible policy response to such a concern is to levy a small tax on inter-partnership dividends.

Harmonize the tax treatment of different types of investments

At present, there are several types of investments that the tax system favors, including investments generating production income (which qualifies for the Section 199 deduction), investments benefiting from accelerated depreciation schedules, and rules that favor the oil-and-gas sector. Policymakers should be sure to avoid tax distortions that skew investment decisions, unless there are strong arguments for positive externalities.

Harmonize the tax treatment of capital and labor income

There is no strong argument for taxing capital at a lighter rate than labor. Similar rates of tax for capital and labor sources of income would make the U.S. tax system more efficient, equitable, and easier to administer. In fact, in the wake of the 1986 tax reform, both the top labor income bracket and the top dividends and capital gains rates were harmonized. Such harmonization eliminates tax incentives to mischaracterize labor income as capital income, and it avoids the substantial theoretical ambiguities associated with drawing a crisp distinction between capital and labor income for entrepreneurial activities.65

In addition, capital income taxation should be buttressed by eliminating the so-called step-up in basis at death, which allows many capital gains to escape tax entirely, disproportionately benefiting those at the top of the income distribution receiving inherited wealth.66 Policy-makers should also consider limiting the size of tax-free retirement accounts.

Reforms that address international corporate tax issues

Several features of the modern global economy make the taxation of multinational firms particularly difficult. First, multinational firms have business operations that are truly integrated across borders. The United States, like other countries, attempts to ascertain the source of global income by asking multinational corporations to separately account for income and expenses in each jurisdiction in which they operate. Yet, the entire economic rationale for multinational corporations is that they create greater profits as integrated firms than they would separately as domestic firms operating at arms’ length. How should this “extra” profit be assigned to a particular source?

Second, the nature of modern economic value makes these sourcing problems more difficult. Much of the source of economic profits, and particularly rents, comes from intangible sources of value. It is easy to spot a factory or workers, but where does an idea reside?

Third, multinational corporations widely treat their tax departments as profit centers, deploying small armies of accountants and lawyers to work assiduously to minimize global tax burdens. While these efforts are generally legal, multinational firms are adept at using complicated financial maneuvers to reduce their tax liabilities.67 The global nature of business and the intangible nature of value both generate substantial ambiguity regarding where profits should be located.

The current system of U.S. taxation of international corporate income generates a large incentive to earn income in low-tax locations, and multinational firms respond to that incentive by booking disproportionate quantities of income in tax haven countries. My prior work suggests that profit shifting is likely costing the U.S. government around $100 billion a year, and other researchers have found similar magnitudes.68 The problems of profit shifting and base erosion are well understood, with the member nations of the Group of 20 and the OECD underscoring this consensus in a just-completed, multi-year process aimed at addressing these issues. Their final reports, issued in the Fall of 2015, totaled nearly 2,000 pages of recommendations and guidelines.

The length of these recommendations speaks to the difficulty of establishing the source of income in a global economy. In addition, country adoption of the OECD suggestions is likely to be partial and incomplete, and the suggestions themselves are also partial and incomplete. For instance, The Economist noted that “the project was flawed from the start because it was impossible to achieve consensus in favour of the radical overhaul that was needed. The result is a patch-up job that offers improvements in certain areas but fails to deal with the core problems.”69

Multinational firms headquartered in the United States also have concerns that the U.S. tax system places them at a competitive disadvantage when competing with firms based in other countries. Yet a close look at such claims proves them to be unfounded. Corporate profits are at historically high levels, both before-tax and after-tax. The United States is also home to a disproportionate share of Forbes Global 2000 list of the world’s most important corporations. The United States share of world GDP in 2014 (in dollar terms) is 22 percent, and the U.S. share of GDP in terms of purchasing power parity, which accounts for different prices levels in different countries, is 16 percent. Yet the U.S. share of the world’s biggest firms is far higher. At the end of 2014, the last year for which complete data are available, U.S.-based firms accounted for 29 percent of all Forbes Global 2000 corporations by count, 31 percent by sales, 35 percent by profits (consolidated worldwide), 24 percent by assets, and 42 percent by market capitalization.70

Thus, corporate tax reform should prioritize the problem of corporate tax base erosion while working to minimize tax-induced distortions. To protect the tax base from profit shifting, several piecemeal steps would be useful. First, a minimum tax could currently tax foreign income that was earned in jurisdictions below some threshold. (The Obama administration has suggested 19 percent.) This would substantially reduce the benefits of deferral and thus the incentive to shift income abroad. It would also greatly reduce the “lock-out” effect for unrepatriated income, since the vast majority of such income is booked in the lowest-tax countries.

Second, tougher “earnings stripping rules” (under section 163(j)) would be helpful. Since one of the key drivers behind inversions is facilitating the subsequent shifting of income out of the U.S. tax base, tightening these rules would also reduce the lure of inversion. (Foreign multinationals are less subject to the limits of current earnings stripping rules.) Marty Sullivan, the chief economist at Tax Analysts, a non-profit organization, has cataloged many previous proposals to tighten these rules.71

Third, corporate inversions could also be addressed through a combination of other measures. including increasing the legal standard for a foreign affiliate to become a parent, a management-and-control test,72 and an exit tax. The exit tax would be levied on repatriating companies based on the U.S. tax due on outstanding stocks of income that have not been repatriated.73

Finally, useful elements of the OECD’s base-erosion and profit-shifting recommendations should be adopted, including (but not limited to) the requirement for country-by-country reporting and the Action Item 2 recommendations, which would address issues surrounding the so called “check-the-box” loophole, which allows multinational firms to designate foreign affiliates as “disregarded entities” for tax purposes.

While these are all useful steps, more fundamental policy changes are likely needed to update the corporate tax system to suit our globally integrated economy. Two solutions that are more far-reaching are worldwide consolidation and formulary apportionment. Under worldwide consolidation, a U.S. headquartered multinational firm would simply consolidate its entire global operations (across the parent and all foreign affiliates) for tax purposes, including losses. Income would then be taxed currently, allowing a credit for foreign taxes.74 A worldwide-consolidation approach has several benefits relative to the current system. There would be less tax-motivated shifting of economic activity or profits to low-tax locations, since such shifting would be less likely to affect a multinational firm’s overall tax burden.75 There would thus be few concerns about inefficient capital allocation or corporate tax base erosion. And there would be no “trapped-cash” problem since income would be taxed currently.

A second option would be to utilize formulary apportionment to assign global income to individual countries based on a formula that reflects their real economic activities. This is the system that U.S. states and Canadian provinces use to assign national income to subnational jurisdictions. A three-factor formula could be used—based on sales, assets, and payroll—but others have also suggested a single-factor formula based on the destination of sales.76 The essential advantage of the formulary approach is that it is provides a concrete way for determining the source of international income that is not sensitive to arbitrary features of corporate behavior, such as a firm’s declared state of residence, their organizational structure, or their transfer pricing decisions. If a multinational firm changes these variables it would not affect their tax burden under formulary apportionment.77 Both of these fundamental reforms are promising.78

Improving tax administration

Regardless of the form that corporate tax reform takes, or whether reform even happens, more funding for the U.S. Internal Revenue Service is essential to the functioning of the corporate tax system. Resources at the IRS have been shrinking relative to both the size of the U.S. economy and the complexity of IRS tasks. As summarized earlier this year by Chuck Marr and Cecile Murray at the Center on Budget and Policy Priorities:

The Internal Revenue Service budget has been cut by 17 percent since 2010, after adjusting for inflation, forcing the IRS to reduce its workforce, severely scale back employee training, and delay much-needed upgrades to information technology systems. These steps, in turn, have weakened the IRS’s ability to enforce the nation’s tax laws and serve taxpayers efficiently, as the National Taxpayer Advocate, the Treasury Inspector General for Tax Administration, the IRS Oversight Board, and the Government Accountability Office have all documented. As seven former IRS commissioners from both Republican and Democratic administrations have written: “Over the past fifty years, none of us has ever witnessed anything like what has happened to the IRS appropriations over the last five years and the impact these appropriations reductions are having on our tax system.”79

Given the complexity associated with taxing both pass-through income and multinational corporations discussed above, a commensurate increase in IRS resources is long overdue.

Conclusion

Some experts argue that, in a global economy, collecting the U.S. corporate income tax is infeasible so it would be better to move to individual taxation of capital income. Yet there are two problems with this argument. First, in light of data that indicate that about three quarters of U.S. equity goes untaxed at the individual level, a wholehearted embrace of this position risks undermining capital taxation more generally.

Second, it is important to remember that the U.S. government has not even tried to modernize the corporate tax to better suit a global economy.80 Despite known legislative remedies that would curb profit shifting and corporate inversions, policymakers have sat idle while the corporate profit-shifting problem increased dramatically in recent years. Despite known changes in law that would reduce discrepancies between pass-through and corporate tax treatments, not even the “carried interest” loophole has been closed. Policymakers have the ability to take many steps that would make the corporate tax system more efficient and fair, but they have yet to take action.

Instead, the U.S. tax system remains relatively unchanged in the face of a dramatically changing economy and greater taxpayer agility. Our corporate tax system ostensibly taxes the worldwide income of multinational firms at a rate of 35 percent. Yet effective tax rates are often much lower, often in the single-digits for multinational firms with intangibles-intensive products and services, and little if any tax is collected on foreign income. The current tax system provides a non-transparent way to subsidize some business activities while leaving other business activities with far less favorable tax treatment. U.S. corporate tax laws should be reformed so that the label of the tax system better matches reality. Such a reform would likely lower the corporate statutory rate while expanding the corporate tax base in several ways. For some firms, the effective corporate tax rate will be higher. For others, it will be lower.

A key principle of any corporate tax reform should be to harmonize the tax rate between different types of income in order to avoid tax shenanigans that mischaracterize income in tax-preferred forms, and to avoid the distortions associated with disparate tax treatment. Foreign income, for example, could be taxed currently, keeping the tax credit for taxes paid abroad. Accompanied by a lower statutory rate, this reform need not raise tax burdens on average, but it would eliminate the large incentive to earn income in low-tax countries. (A minimum tax for income earned in the lowest tax countries would be a big step in that direction.) Also, tax policy changes could harmonize the tax treatment for debt- and equity-financed investments, for corporate and non-corporate income, for different types of investment, and for capital and labor income.

Regardless of the precise path that reformers take, it is important to remember that the U.S. corporate tax has a vital role to play in the U.S. tax system. It is one of our only tools for taxing capital income, since most corporate income is untaxed at the individual level. The corporate tax is an important source of revenue and it also has a vital role in protecting the personal income tax system. Recent economic theory buttresses the case for taxing capital on efficiency grounds. The corporate tax is also an important part of the progressivity of the tax system, since a majority of the tax falls on capital or on rents. In this regard, the role of the corporate tax has become more important, since capital income has become a larger share of GDP in recent decades, and capital income is far more concentrated than labor income.

In sum, the case for a healthy corporate tax is alive and well. The remaining question is whether the requisite political will can be summoned to reform and strengthen our corporate tax system.

References

End Notes

1. This reluctance (termed “lock out”) is in large part due to the expectation of favorable changes in future tax treatment that make paying the tax due upon repatriation unattractive under current law. While unrepatriated earnings are often invested in U.S. assets, and there is no evidence that the “lock out” effect reduces productive investments in the United States (since these cash-rich corporations are not credit-constrained), repatriation should still be addressed through policy reform.

2. See Table B-19, Economic Report of the President: see appendix B: https://www.whitehouse.gov/administration/eop/cea/economic-report-of-the-President/2016.

3. Such businesses are referred to as pass-through business since income flows through to the business owners and is taxed at the individual level.

4. Kimberly A. Clausing, “The Effect of Profit Shifting on the Corporate Tax Base in the United States and Beyond.” National Tax Journal, December 2016 (forthcoming). http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2685442.

5. Michael Cooper, John McClelland, James Pearce, and Richard Prisinzano “Business in the United States: Who Owns It and How Much Tax Do They Pay?” NBER Working Paper Series No. 21651, (Cambridge, MA: 2015), http://www.nber.org/papers/w21651.

6. Explanations for the increasing capital share vary but most have technical change as an essential component. Karabarbounis and Neiman argue that the declining price of investment goods (due in part to the technical changes surrounding computing), combined with an elasticity of substitution between labor and capital exceeding one, can account for an important part of these capital share trends. Other explanations include capital augmenting technical progress, globalization (though common trade theories cannot explain the prevalence of these trends, nor their within industry component), and institutional and bargaining considerations. See Loukas Karabarbounis and Brent Neiman, “The Global Decline in the Labor Share.” Quarterly Journal of Economics 129, no.1 (2014): 61–103.

7. Margaret Jacobson and Felippo Occhino, “Labor’s Declining Share of Income and Rising Inequality.” Federal Reserve Bank of Cleveland Economic Commentary, (Cleveland, OH: Federal Reserve Bank of Cleveland, 2012).

8. International Labour Organization and Organisation for Economic Cooperation Development, “The Labour Share in G20 Economies, “ Report prepared for the G20 Employment Working Group (Antalya, Turkey: G20 Employment Working Group, 2015). The report cites other research by the International Monetary Fund in 2007, the European Commission in 2007, the Bank for International Settlements in 2006, and the International Labor Organization in 2012.

9. Karabarbounis and Neiman, “The Global Decline in the Labor Share.” The focus on the corporate sector helps isolate key economic mechanisms at hand, since it avoids thorny issues surrounding how to crisply divide the labor and capital components of unincorporated business income; it also avoids questions regarding the labor share of government and issues surrounding residential investments and their depreciation.

10. Ibid.

11. Benjamin Bridgeman, “Is Labor’s Loss Capital’s Gain?” Working Paper, (Washington, DC: Bureau of Economic Analysis, 2014), https://bea.gov/papers/pdf/laborshare1410.pdf

12. Loukas Karabarbounis and Brent Neiman, “Capital Depreciation and Labor Shares Around the World: Measurement and Implications, ” NBER Working Paper Series 20606, (Cambridge, MA: National Bureau of Economic Research, 2014), http://www.nber.org/papers/w20606.

13. Michael W. Elsby, Bart Hobijn, and Aysegul Sahin. 2013. “The Decline of the U.S. Labor Share.” Brookings Papers on Economic Activity, (Washington, DC: Brookings Institute, 2013):1–52, http://faculty.chicagobooth.edu/brent.neiman/research/Neiman_Comments_for_BPEA.pdf

14. Victor Fleischer, “Alpha: Labor Is the New Capital,” Tax Law Review (forthcoming 2016)

15. Yet as noted in Elsby, Hobijn, and Sahin, “The Decline of the U.S. Labor Share,” (p.23-24), the exercise of stock options is included in the payroll share of labor income. Big increases in the payroll share at the turn of the century were associated with the exercise of stock options in the tech and banking sectors during the tech bubble. These two sectors alone account for a big part of the volatility in the payroll share in recent decades.

16. Some selections from this section are excerpted from Kimberly A. Clausing, “The Future of the Corporate Tax.” Tax Law Review 66, no. 4 (2013): 419–443.

17. Alan J. Auerbach and James R. Hines, Jr. “Taxation and Economic Efficiency” In Handbook of Public Economics Volume 3, edited by Alan J. Auerbach and Martin Feldstein, 1347–1421, (New York: North Holland, 2002).

18.

Kenneth L. Judd, “Redistributive Taxation in a Simple Perfect Foresight Model.” Journal of Public Economics 28 (1985): 59–83; Christophe Chamley, “Optimal Taxation of Capital Income in General Equilibrium with Infinite Lives,” Econometrica 54 (1986): 607–22. Anthony B. Atkinson and Joseph E. Stiglitz, “The Design of Tax Structure: Direct versus Indirect Taxation.” Journal of Public Economics 6 (1976): 55–75.

Subsequent analysis has confirmed these results. See: Larry E. Jones, Rodolfo E. Manuelli, and Peter E. Rossi. “On the Optimal Taxation of Capital Income.” Journal of Economic Theory 73 (1997): 93–117. Andrew Atkeson, V.V. Chari, and Patrick J. Kehoe, “Taxing Capital Income: A Bad Idea.” Federal Reserve Bank of Minneapolis Quarterly Review 23 (1999): 3–17. However, recent work by Ludwig Straub and Ivan Werning shows that even within the context of the Chamley/Judd models’ assumptions, the zero capital tax result can be overturned. As they note in their conclusion, “We confined attention to the original theoretical results, widely perceived as delivering zero long-run taxation as an ironclad conclusion, independent of parameter values. Based on our analysis, we find little basis for such an interpretation.” See Ludwig Straub and Ivan Werning, “Positive Long Run Capital Taxation: Chamley-Judd Revisited.” NBER Working Paper No. 20441, (Cambridge, MA: National Bureau for Economic Research, 2014), http://www.nber.org/papers/w20441.

19. See, for example, arguments within Anthony B. Atkinson and Joseph E. Stiglitz, Lectures in Public Economics, (Princeton, NJ: Princeton University Press, 2015). and Joseph E. Stiglitz, The Price of Inequality (New York: W.W. Norton, 2012).

20. Atkinson and Stiglitz, Lectures in Public Economics.

21. Juan Carlos Conesa, Sagiri Kitao, and Dirk Krueger, “Taxing Capital? Not a Bad Idea After All!” American Economic Review 99 (2009): 25–48.

22. Thomas Piketty and Emmanuel Saez, “A Theory of Optimal Capital Taxation.” NBER Working Paper No. 17989, (Cambridge, MA: National Bureau of Economic Research, 2012), http://www.nber.org/papers/w17989; Thomas Piketty and Emmanuel Saez, “A Theory of Optimal Inheritance Taxation.” Econometrica 81, no.5 (2013): 1851–86.

23. Farhi, Emmanuel, Christopher Sleet, Ivan Werning, and Sevin Yeltekin. 2012. “Non-Linear Capital Taxation Without Commitment.” Review of Economic Studies 79, no. 4 (2012): 1469-1493.

24. These considerations are discussed in more detail in Peter Diamond and Emmanuel Saez, “The Case for a Progressive Tax: From Basic Research to Policy Recommendations.” Journal of Economic Perspectives 25 (2011): 165–90.

25. See data provided in the introduction of Piketty and Saez, “A Theory of Optimal Capital Taxation.”

26. Simeon Djankov, Tim Ganser, Caralee McLiesh, Rita Ramalho, and Andrei Schleifer, “The Effect of Corporate Taxes on Investment and Entrepreneurship.” American Economic Journal: Macroeconomics 2 (2010): 31–64. As the authors note, other studies do not typically use cross-country analysis. In their analysis, they employ a cross-section of 85 countries in 2004. They find that effective tax rates, but not statutory rates, have a statistically significant effect on overall investment. Yet the influence of effective tax rates on investment is still subject to caveats: (i) the absence of time series variation makes it impossible to control for country-specific fixed effects, (ii) the effect loses statistical significance when a complete set of control variables are added, and (iii) the effect loses statistical significance if Bolivia is excluded from the analysis, as noted by Gravelle and Hungerford (2012).

27. See Piketty and Saez, “A Theory of Optimal Capital Taxation,” page 6.

28. See, for example, Partha Dasgupta and Joseph E. Stiglitz, “Differential Taxation, Public Goods, and Economic Efficiency.” Review of Economic Studies 38 (1971): 151–74.

29. McClelland, John McClelland, Elena Patel, and Laura Power. 2016. “Where’s The Cash? What Would a U.S. Cash Flow Tax Look Like.” (Washington, DC: Presentation for NTA Spring Symposium, 2016).

30. Steven M. Rosenthal and Lydia S. Austin, “The Dwindling Taxable Share of U.S. Corporate Stock.” Tax Notes (May 2016): 923–34. Leonard E. Burman and Kimberly A. Clausing, “Is U.S. Corporate Income Double-Taxed?” Working Paper, (2016) explores data from a broader range of sources, all of which suggest that only a minority fraction of corporate equity is subject to individual income taxation in the United States, (although the fraction may be somewhat higher than estimated by Rosenthal and Austin).

31. There are also valuation issues associated with non-publicly traded assets. One possible solution is to give taxpayers the option of deferring tax until the asset is sold, assigning an interest charge in the meantime. This does raise some technical issues.

32. U.S. Census Bureau, “Historical Income Tables: Households,” June 2, 2016, http://www.census.gov/data/tables/time-series/demo/income-poverty/historical-income-households.html.

33. Congressional Budget Office, “The Distribution of Household Income and Federal Taxes, 2013”. Supplemental Data. https://www.cbo.gov/publication/51361 Internal Revenue Service, “SOI Tax Stats- Individual Statistical Tables by Tax Rate and Income Percentile,” July 12, 2016, https://www.irs.gov/uac/soi-tax-stats-individual-statistical-tables-by-tax-rate-and-income-percentile.

34. http://www.taxpolicycenter.org/model-estimates/distribution-capital-gains-and-qualified-dividends/distribution-long-term-capital-2

35. Facundo Alvaredo, Anthony Atkinson, Thomas Piketty, Emmanuel Saez, “The Top 1 Percent in International and Historical Perspective,” Journal of Economic Perspectives 27, no.3 (2013): 3–20.

36. “Statistics of Income Division, Research, Analysis and Statistics, “The 400 Individual Income Tax Returns Reporting the Largest Adjusted Gross Incomes Each Year, 1992-2013,” (Washington, DC: Internal Revenue Service, 2015), https://www.irs.gov/pub/irs-soi/13intop400.pdf

37. See Julie-Anne Cronin, Emily Y. Lin, Laura Power, and Michael Cooper. “Distributing the Corporate Income Tax: Revised U.S. Treasury Methodology.” Office of Tax Analysis: Technical Paper 5, (Washington, DC: Office of Tax Analysis, 2012), https://www.treasury.gov/resource-center/tax-policy/tax-analysis/Documents/TP-5.pdf.

38. See Jim Nuuns, “How TPC Distributes the Corporate Tax,” (Washington, DC: Tax Policy Center, 2013), http://www.taxpolicycenter.org/sites/default/files/alfresco/publication-pdfs/412905-Who-Benefits-from-Tax-Exempt-Bonds-An-Application-of-the-Theory-of-Tax-Incidence.PDF

39. See Congressional Budget Office (2014) “The Distribution of Household Income and Federal Taxes, 2011,” https://www.cbo.gov/sites/default/files/113th-congress-2013-2014/reports/49440-Distribution-of-Income-and-Taxes-2.pdf

40. As discussed in Joint Committee on Taxation, “Present Law and Issues in U.S. Taxation of Cross-Border Income,” JCX-42-11, (Washington, D.C.: Joint Committee on Taxation, 2011), page 30, “In the short run the new method distributes 100 percent of both types of taxes to owners of capital. In the long run it distributes 75 percent of corporate income taxes and 95 percent of the taxes attributable to pass-through business income to owners of capital.”

41. A thorough review is provided in Clausing, “In Search of Corporate Tax Incidence.”

42. For an early model, see Arnold C. Harberger, “The Incidence of the Corporate Income Tax.” Journal of Political Economy 70 (1962): 215–40. Later models include: Arnold C. Harberger, “The ABC’s of Corporate Tax Incidence: Insights into the Open Economy Case,” (Washington, D.C.: American Council for Capital Formation, 1995): 51–73; William C. Randolph, “International Burdens of the Corporate Income Tax.” Congressional Budget Office Working Paper Series, Washington, DC: Congressional Budget Office, 2006), Jane G. Gravelle and Kent A. Smetters, “Does the Open Economy Assumption Really Mean That Labor Bears the Burden of a Capital Income Tax?” Advances in Economic Analysis and Policy 6, no. 3 (2006).

43. Jennifer C. Gravelle, “Corporate Tax Incidence: Review of General Equilibrium Estimates and Analysis.” Congressional Budget Office Working Paper Series. (Washington, D.C.: Congressional Budget Office, 2010).

44. Jane G. Gravelle and Thomas L. Hungerford. 2008. “Corporate Tax Reform: Should We Really Believe the Research?” Tax Notes (2008), http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1289354

45. Alan J. Auerbach, “Why Have Corporate Tax Revenues Declined? Another Look.” NBER Working Paper No. 12463. (Cambridge, MA: National Bureau of Economic Research, 2006), http://www.nber.org/papers/w12463.

46. Nadine Riedel, “Taxing Multi-Nationals Under Union Wage Bargaining.” International Tax and Public Finance 18, no. 4 (2011): 399-421.

47. While work by Kevin A. Hassett and Aparna Mathur, “Spacial Tax Competition and Domestic Wages,” SSRN paper 2010, http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2212975 indicated large wage effects from corporate taxation, these results were shown to be sensitive to specification choice by both Gravelle and Hungerford, “Corporate Tax Reform: Should We Really Believe the Research?” and Clausing, “In Search of Corporate Tax Incidence.” Similar problems plague studies on cross-country incidence by R. Alison Felix, “Passing the Burden: Corporate Tax Incidence in Open Economies,” Federal Reserve Bank of Kansas City Working Paper, (2007) and Mihir A. Desai, C. Fritz Foley, and James R. Hines Jr. “Labor and Capital Shares of the Corporate Tax Burden: International Evidence.” Working Paper, (December 2007).

48. Clausing, “In Search of Corporate Tax Incidence” and Clausing, “Who Pays the Corporate Tax in a Global Economy?” use several different methods, (a) a method modeled on Hassett and Mathur, (b) panel regression analyses, with due consideration for both dynamic influences and adequate control variables, and (c) a vector autoregression analysis. The reader is referred to Clausing (2012, 2013b) for the full analyses.

49. See Kimberly A. Clausing, “The Effect of Profit Shifting on the Corporate Tax Base in the United States and Beyond,” National Tax Journal, December 2016 (forthcoming).

50. Wiji Arulampalam, Michael P. Devereux, and Giorgia Maffini, “The Direct Incidence of Corporate Taxes on Wages.” IZA DP No. 5293, (October 2010); Nils aus dem Moore and Tanja Kasten,“Do Wages Rise When Corporate Tax Rates Fall? Differences-in-Differences Analyses of the German Business Tax Reform 2000,” February 2009, http://piketty.pse.ens.fr/files/MooreKasten2009.pdf; Nadja Dwenger, Pia Rattenhuber, and Viktor Steiner,“Sharing the Burden: Empirical Evidence on Corporate Tax Incidence.” (Munich, Germany: Max Planck Institute for Tax Law and Public Finance, 2011), Li Liu and Rosanne Altshuler, “Measuring the Burden of the Corporate Tax Under Imperfect Competition,” National Tax Journal 66, no. 1 (2013): 215–38.

51. Dwenger, Rattenhuber, and Steiner, “Sharing the Burden: Empirical Evidence on Corporate Tax Incidence.”

52. Juan Carlos Suarez Serrato and Owen Zidar, “Who Benefits from State Corporate Tax Cuts? A Local Labor Markets Approach with Heterogeneous Firms,” American Economic Review (forthcoming, 2016).

53. See Table B-19, Economic Report of the President. See appendix B: https://www.whitehouse.gov/administration/eop/cea/economic-report-of-the-President/2016.

54. I am grateful to Larry Summers for an early articulation of this point. See “Reforming Taxation in the Global Age,” (Washington, DC: The Hamilton Project, 2007), www.hamiltonproject.org/events/reforming_taxation_in_the_global_age.

55. Jukka Pirttila and Hakan Selin, “Income Shifting within a Dual Income Tax System: Evidence from the Finnish Tax Reform of 1993,” Scandinavian Journal of Economics 113 (2011): 120–44.

56. Gravelle, Jane G. and Thomas L. Hungerford. 2008. “Corporate Tax Reform: Should We Really Beleve the Research?” Tax Notes (2008), http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1289354. This analysis assumes a top labor income rate of 35% and dividends taxed at 15%. Assuming instead a top labor rate of 39.6% and dividends taxed at 20% would mean the corporate form would provide sheltering opportunities at a rate of 27% for corporations that distributed less than 86% of their earnings.

57. Michael Cooper, John McClelland, James Pearce, and Richard Prisinzano. “Business in the United States: Who Owns It and How Much Tax Do They Pay?” NBER Working Paper Series No. 21651 (Cambridge, MA: National Bureau of Economic Analysis, 2015).