A childcare plan for wealthy families in the United States

The vast majority of children up and down the income scale grow up in dual-earner or single-parent homes. Without a parent who is able to care for children at home, American families are in search of affordable, safe childcare, but rising prices are making it hard for workers to access childcare in pursuit of balancing their work and personal responsibilities. During his presidential campaign, Donald Trump proposed three new tax benefits for childcare aimed at bringing relief to middle-class families. A recent analysis of his proposals by Lily Batchelder of New York University and her coauthors, however, shows that this plan fails at providing relief to middle-class families. Both in terms of dollars and as a share of household income, these benefits would be much larger for high-income families than for low- and middle-income families in America.

As part of President Trump’s overall tax-reform plan, he proposes an expanded credit for low-income families, a deduction for higher-income families, and a childcare savings account, as compared to the current small nonrefundable credit for childcare known as the Child and Dependent Care Tax Credit. In general, the proposal allows a couple making less than $500,000 annually ($250,000 for single parents) to deduct the cost of childcare from their taxable income (up to the state average cost of childcare), while those who earn too little to owe any income tax would be eligible to receive a smaller refundable credit. In addition, his proposal would allow families to set up an account to save tax-free for childcare expenses and other related expenses such as private-school tuition and extracurricular activities.

This proposal relies most heavily on a deduction. Indeed, this deduction is worth most per dollar spent on childcare to higher-income families who face higher marginal tax rates, while the credit available to lower-income families is worth much less per dollar spent on childcare than the deduction—tilting the benefits toward higher-income families. What’s more, the tax-free savings accounts for childcare and other related expenses is unlikely to benefit low- and moderate-income families because they tend to be strapped for cash.

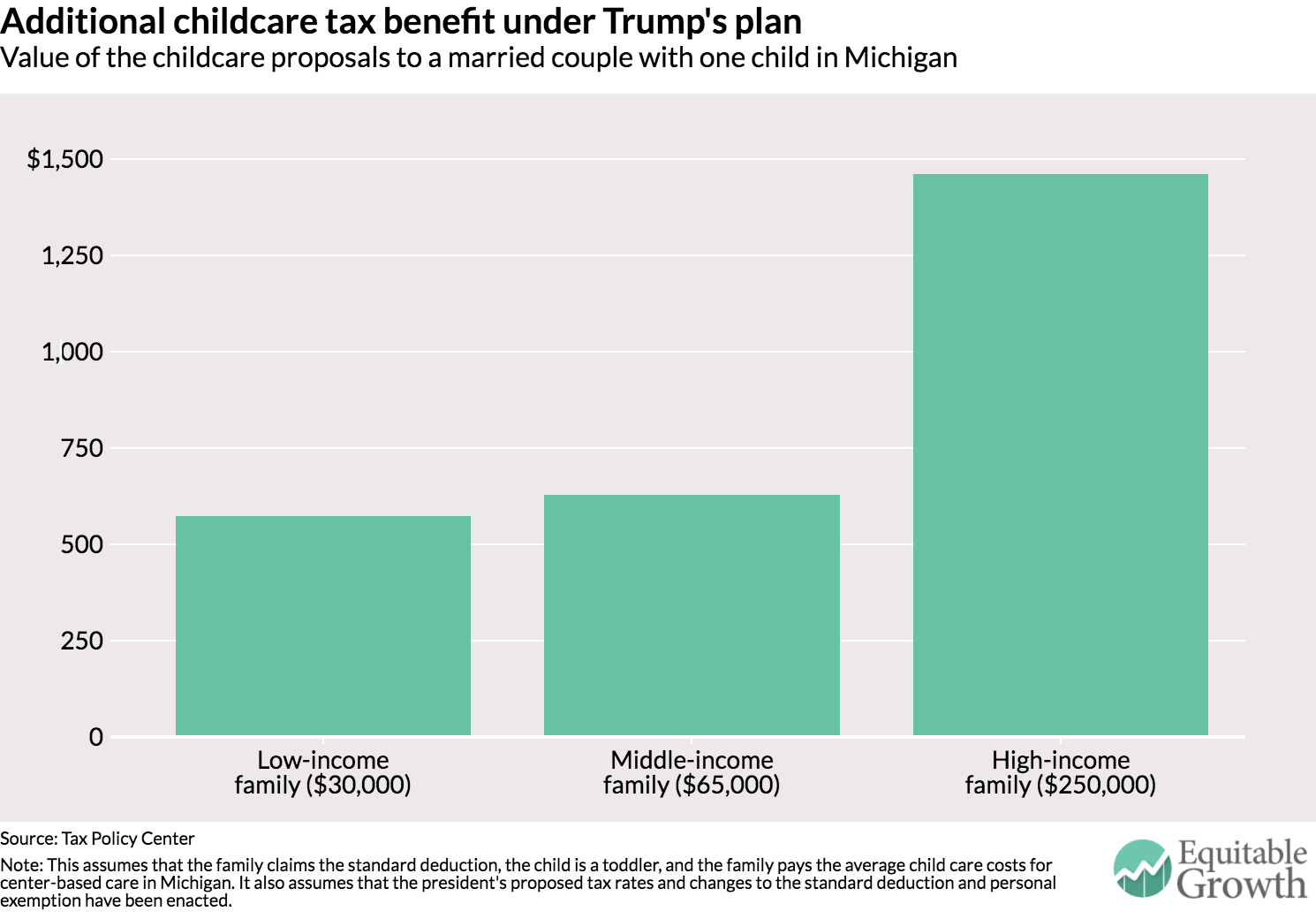

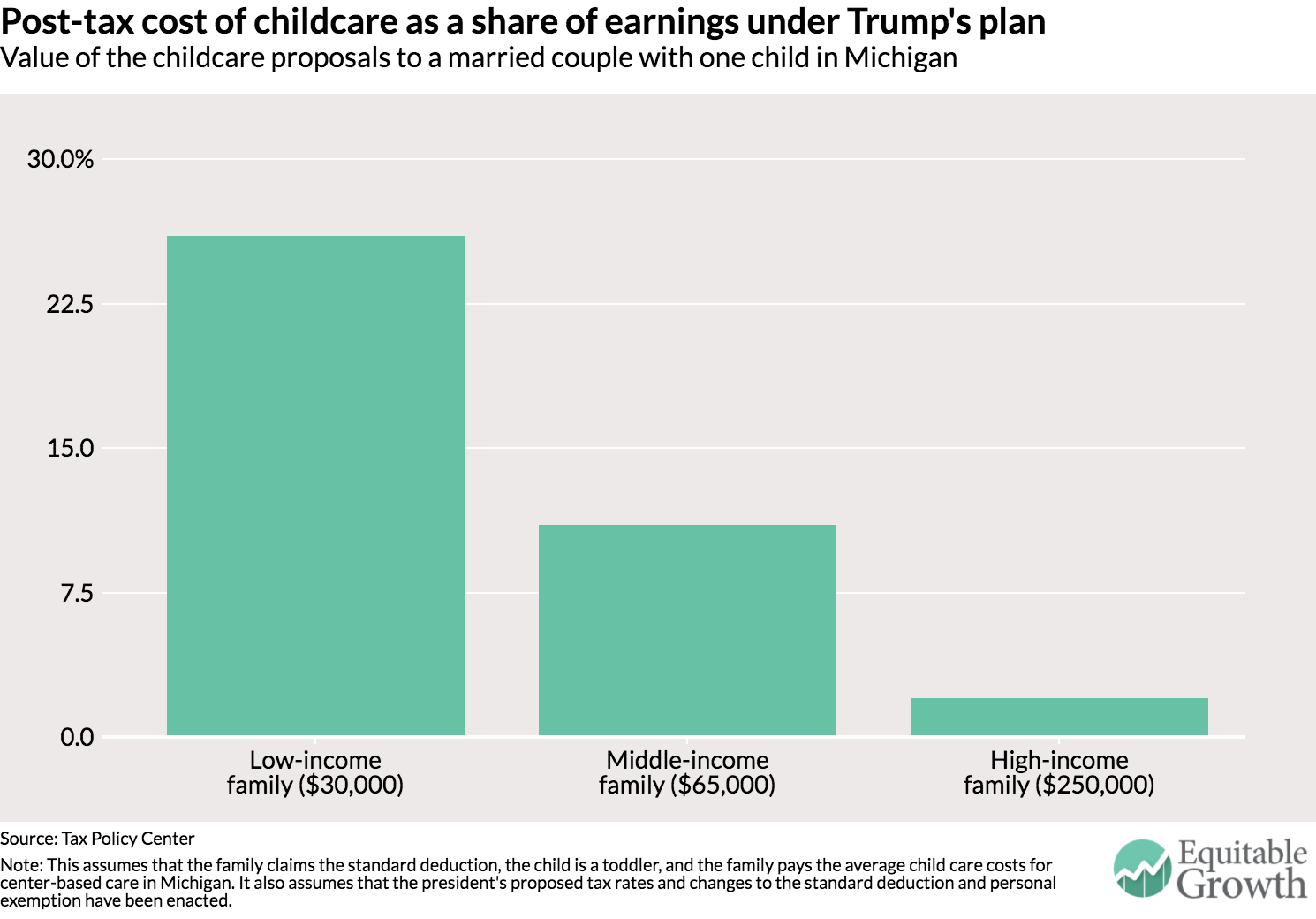

Batchelder and her coauthors illustrate the regressivity of Trump’s child tax credit proposal by considering how these policies would affect the tax liability of a hypothetical family. They consider a married couple with a 4-year-old living in Michigan, where the average annual childcare cost for a child that age is $8,238, close to the median in America. (See Figures 1 and 2.)

Figure 1

Figure 2

If both parents make the same amount earning the federal minimum wage, then their household income would be $30,000 and this proposal would reduce their tax liability by $574 in 2017. Meanwhile, if the same family had combined earnings of $250,000, then its tax liability would be reduced by $1,460 more than the currently allowed deduction. Overall, the low-income family still pays 26 percent of its income in childcare costs after the tax credit, whereas the high-income family pays only 2 percent of its income for childcare services after applying the tax credit.

Although Trump’s plan attempts to tackle the issue of rising childcare costs, it fails at doing so for the families that need it most. Helping low- and middle-income families cope with rising childcare costs is imperative for parents, their kids, and the broader U.S. economic growth and productivity. In her book, “Finding Time,” Equitable Growth’s Heather Boushey offers a broad-based policy agenda to address the economic issues of family and life, including the burdensome childcare costs that American families face today. Many experts have suggested replacing the current Child and Dependent Care Tax Credit and dependent care flexible spending accounts with a refundable credit that limits childcare to a fixed proportion of household income, which would make Trump’s childcare support more progressive and would benefit those who need the most help.