Testimony by Heather Boushey before the Ways and Means Committee

Washington Center for Equitable Growth

Testimony before the Ways and Means Committee

Subcommittee on Select Revenue Measures

Hearing on “How Middle Class Families are Faring in Today’s Economy”

Remarks as Delivered

February 13, 2019

Thank you, Chairman Thompson and Ranking Member Smith for extending me an invitation to speak today. I am honored to be here. My name is Heather Boushey and I am Executive Director and Chief Economist at the Washington Center for Equitable Growth.

I’m here to talk about the state of the American middle class and evidence-backed ideas and policies that you as a Subcommittee and as lawmakers can use to promote strong, stable, and broad-based economic growth. That is also the focus of our Center.

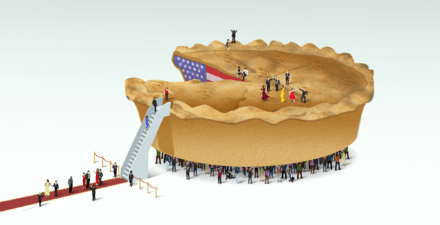

Statistics that we use to measure the economy, like GDP and job numbers, have become less representative of what people across the U.S. and your constituents are feeling. There is a reason that the President’s boasts of 4 percent growth ring hollow to those who you meet at home. Headline GDP numbers don’t tell us how that growth is distributed, just as headline job numbers do not tell us if good jobs are being created. The question of who gains from economic growth is crucial to understand.

Research from the economists Thomas Piketty, Emmanuel Saez, and Gabriel Zucman show that for the 117 million U.S. adults in the bottom half of the income distribution, economic growth has been non-existent for a generation. Meanwhile, the income of the top 1 percent has tripled since 1980.

As incomes have stagnated, the building blocks of a stable middle class living have steadily become more expensive. Health care, child care and education are a few fundamental, but increasingly unaffordable, pillars of the American Dream. A median-income family has to spend nearly 20 percent of their income to cover childcare costs. The total cost to attend a four-year university has increased from $26,000 to more than $100,000 over the past four decades. The U.S. is unique among rich countries in not providing workers with nationwide access to paid family and medical leave.

Rising inequality and increasing barriers to a middle-class life are limiting economic mobility. Economist Raj Chetty found that upward absolute mobility in the U.S. declined precipitously between the mid-1900s and today. Children born in 1940 had a 90 percent chance of earning more than their parents. For children born in 1980, it was only a 50-50 chance. This is wrong. Chetty’s analysis shows that 70 percent of the decline in mobility happened because of rising inequality. Thus, to improve mobility, we must address inequality.

This Subcommittee has a vital role to play in rebalancing policy toward the majority of Americans. The Tax Cuts and Jobs Act is contributing to inequality in the United States by lavishing benefits on corporate shareholders and the already wealthy. The Tax Cuts and Jobs Act cut taxes for those at the top in the long run, while decreasing the revenue available to fund investments in family economic security, like education, healthcare, childcare and housing. The purpose of the tax system, as with public policy in general, is to support the living standards of U.S. families.

So what can you do about this? Your policy agenda should comprehensively address economic issues at the bottom, middle, and top of the income spectrum. At the bottom end, one easy step is to preserve and expand evidence backed refundable tax credits like the Earned Income Tax Credit and the Child Tax Credit, which lifted 8.9 million Americans out of poverty in 2017.

In the middle, it is important to make sure the fruits of growth are widely shared and to make the economy work for workers and families. Some proven ways to do this include making sure every family can afford to send their children to high quality, affordable childcare and offering a national paid family and medical leave. It can also mean investing in infrastructure.

And we need to know much more about the top. Many of the statistics we rely on to inform us about the state of our economy are measures of the average. In an era of rising inequality, overall GDP numbers are becoming less informative about the experience of the majority of people you represent. The Measuring Real Income Growth Act, introduced by Representative Carolyn Maloney, would disaggregate quarterly or annual GDP growth numbers. This would tell us what growth is experienced by low-, middle-, and high-income Americans.

Instead of promising “4 percent growth,” the goal could become “4 percent growth for the middle class.” This data should be made available in real time so we can design policies to lift up those groups that really need it.

Thank you again.