Trump administration 2018 budget swaps heavy cuts to education for focus on school choice

President Donald Trump’s budget for fiscal year 2018 beginning October 1 and released this past Tuesday contains some potentially bad news for the state of education in the United States. Under the guise of “refocusing” funding priorities, the budget proposes a 13 percent, or $9 billion, cut for the Department of Education. On the chopping block are programs such as public service student loan forgiveness, Supporting Effective Instruction State Grants, and 21st Century Community Learning Centers. Despite these, and other, rollbacks on spending for Kindergarten through 12th grade and higher education, the budget did reflect the Trump administration’s misplaced commitment to advancing one aspect of education—school choice—using mechanisms such as vouchers to help students access schools that best suit their needs.

A more detailed statement released by the Department of Education reveals that approximately $1.4 billion in the education budget will be directed toward expanding investments in public and private school choice options. This includes $1 billion for Furthering Options for Children to Unlock Success grants, which allow students in high-poverty schools to choose to attend other public schools and take their voucher with them. Additionally, it calls for a $250 million increase for programs that award scholarships for low-income children to attend private school and a $167 million increase to expand state efforts on charter schools.

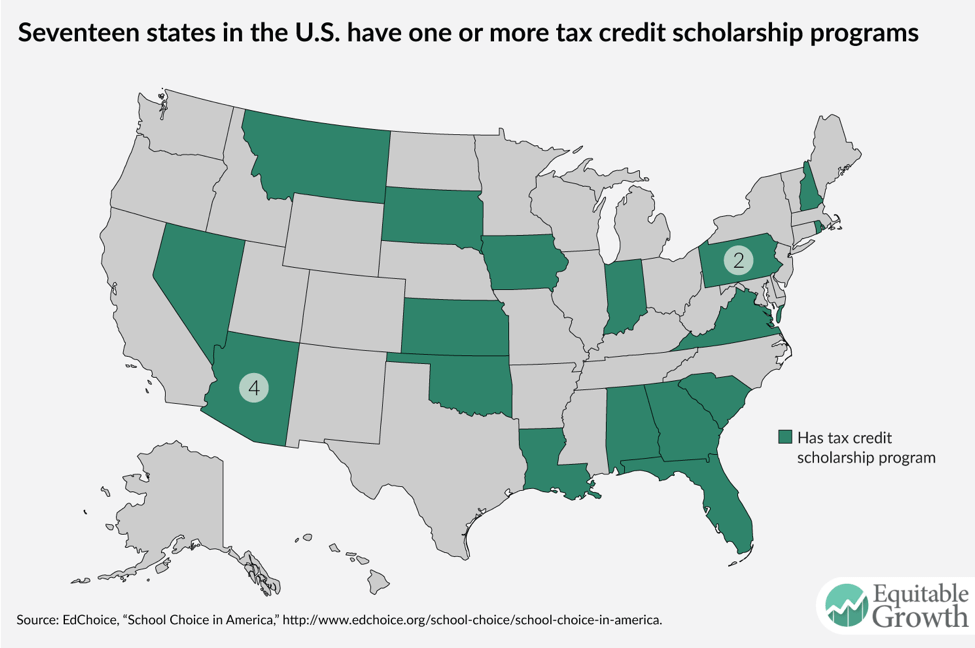

All this said, the Department of Education’s detailed budget leaves out much-anticipated information about the administration’s controversial school choice program—tax credit scholarships. In general, tax credit scholarships, sometimes called “neovouchers,” work by giving individuals, businesses, or both partial to full tax credits for their donations to nonprofit organizations that offer scholarships to private and religious primary and secondary schools. Currently, 17 states operate one or more tax credit scholarship programs, with roughly 250,000 enrollees nationwide. In some states, such as Indiana and Oklahoma, tax credits are slated at 50 cents on the donated dollar, but in several others, such as Alabama, Arizona, Florida, Georgia, Montana, Nevada, and South Carolina, taxpayers can receive up to dollar for dollar tax credits. (See Figure 1.)

Figure 1

While in theory using tax credit scholarships can increase K-through-12 school choice, there are two key problems with these programs.

The most egregious problem, as a matter of tax policy, with tax credit scholarships is that in some states, taypayers can turn a profit on them through a loophole. According to a new report by Carl Davis of the Institute on Taxation and Economic Policy, in the states in which credits equal a dollar on the dollar donated, donors not only get the tax credit but also can claim the charitable federal tax deduction. As a result of this double-dipping, individuals may actually realize a profit on their donation.

The more fundamental problem is that there isn’t much evidence that school choice programs, specifically vouchers, have substantial positive effects on the students they are meant to serve. A review of the literature in 2011 by researchers at the Center on Education Policy at The George Washington University found that school vouchers had no concrete positive impact on students’ educational achievement. A more recent study of the Louisiana Scholarship Program—a voucher program that provides publicly financed scholarships for K-through-12 students to go to private schools—even found negative effects. Scholarship recipients who were performing at the median level prior to entering the program were 13 percentile points lower than their non-scholarship counterparts after two years in the program.

Given these concerns, the Trump administration and the Department of Education should reconsider (or flat-out ditch) their yet-to-be unveiled tax credit scholarship program. But beyond tax credit scholarships and supporting school choice, investing in programs that more reliably shrink educational achievement gaps and improve the quality of publicly funded education can best promote more equitable outcomes for all students.