The vast wealth gap between black and white women in the United States

Women of all races in the United States don’t get paid as much as men for doing the same job, but the financial discrepancies for black women are especially troubling. That’s not just in terms of income—black women bring home 63 cents (compared to 75 cents for white women) for every dollar a white man earns—but also in terms of wealth. A new report looks at household wealth between black and white women and find that black women face a glaring gap in terms of wealth in comparison to men as well as to white women.

The report, by Khaing Zaw, Anne Price, William Darity, Jr., all of Duke University, Jhumpa Bhattacharya of the Insight Center for Community Economic Development, and Darrick Hamilton of The New School of Social Research, is important in an era in which women are increasingly playing the role of breadwinner and a growing number of men are dropping out of the labor force altogether. But as the authors point out, black women face more significant roadblocks despite having the highest growth rate of college enrollment of any other group.

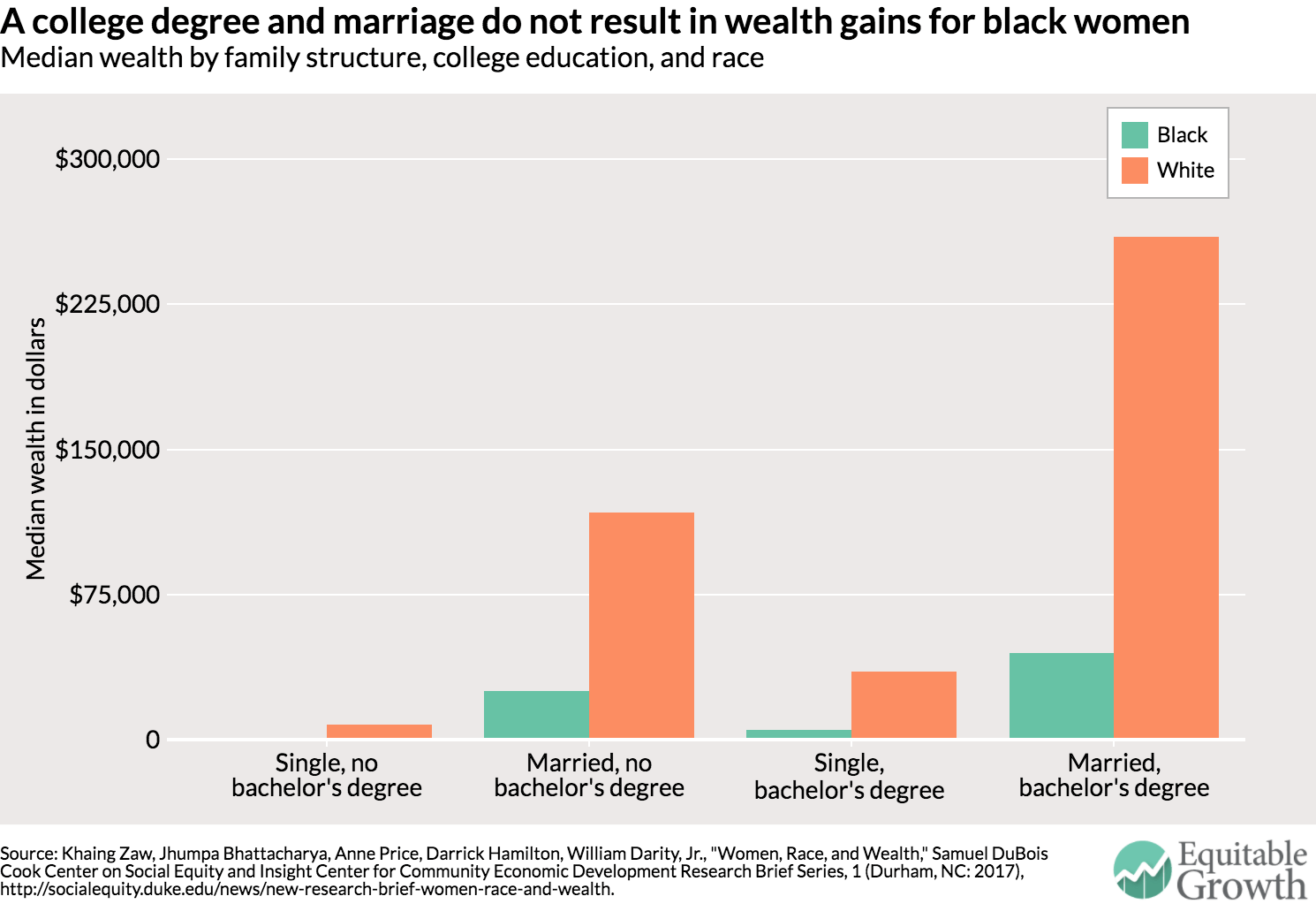

The authors of the report look at patterns of household wealth between black and white women, separating the results out by education and marital status, both of which are traditionally seen as a factor in women’s wealth accumulation. They find that marriage and education do have a significant impact on how much wealth white women amass compared to married and/or educated black women, who only see slight increases—and the wealth gap is even wider compared to single, uneducated women. (See Figure 1.)

Figure 1

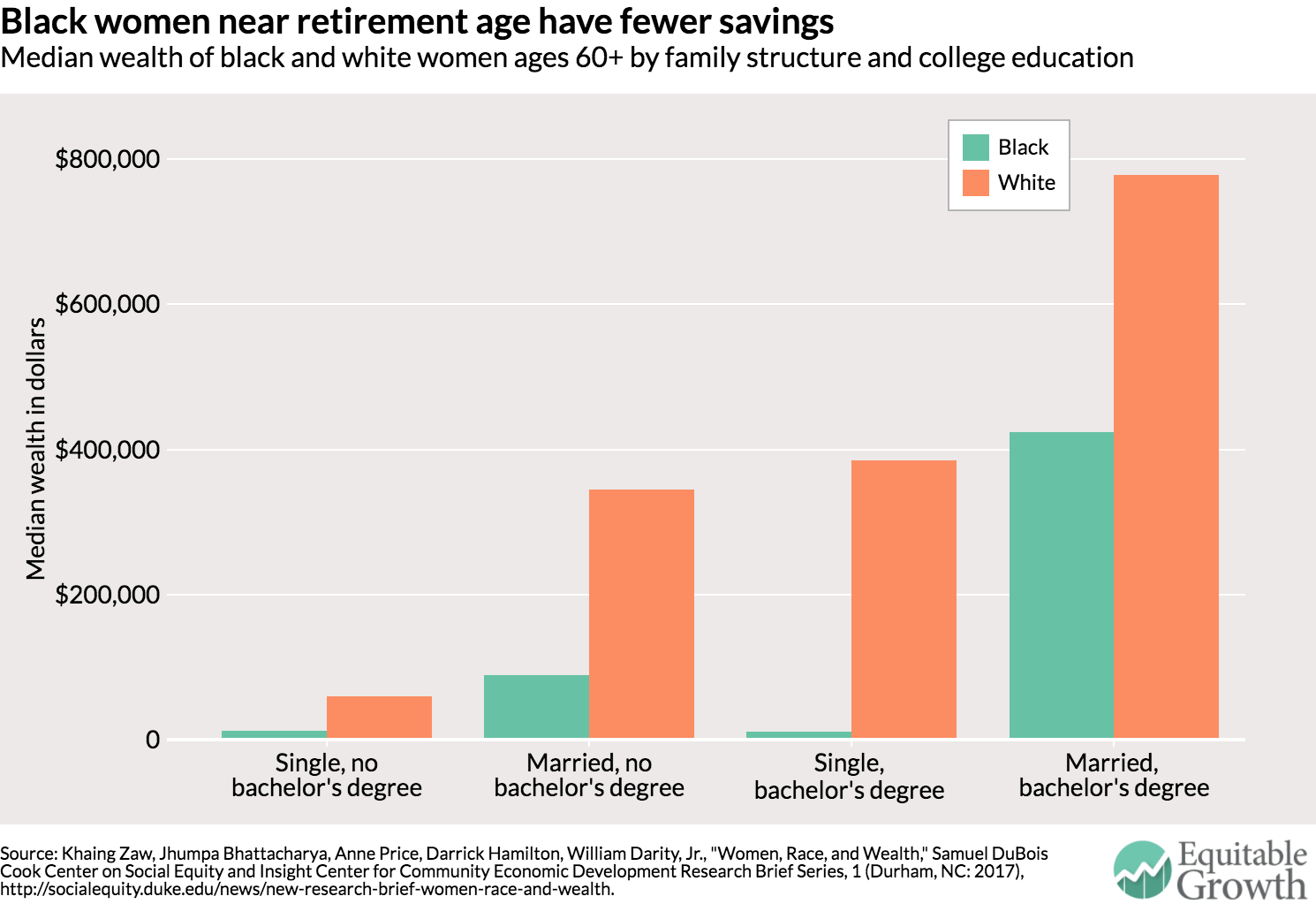

Wealth is measured by the total of one’s assets—cash in banks, stocks, bonds, and real estate—minus debts such as home mortgages, auto loans, credit card debt, and student loans. Therefore, it’s important to note that a young woman who has a well-paying job but is paying off student debt and a mortgage isn’t necessarily in bad financial shape. Instead, she is investing in things that will likely yield high returns in the future. But when the five researchers separate out their results by age, they find that the wealth gaps persist even among older women, who are more likely to have paid off these kinds of investments. (See Figure 2.)

Figure 2

The median wealth levels of single black women ages 60 and older with a college degree is $11,000 compared to a whopping median of $384,400 for their white counterparts, nearly 35 times the black median. And, while married, college-educated black women see greater gains, it is still half of what white women in the same category have accumulated. In an era in which employers are rapidly moving away from traditional pensions and toward individual retirement plans, the fact that black women have been hindered from saving enough is a big problem.

This is just one of the reasons that wealth inequality in the United States is arguably just as important, if not more important, than income inequality. While income is used to pay for daily and monthly necessities, it is the accumulation of wealth that allows individuals and families to attain long-term financial stability. Wealth allows families to buy a home, start a business, or make other forward-looking investments. It serves as a buffer in the case of job-loss or illness. Family wealth is also passed onto the next generation, whether through direct transfers or indirect ones such as college tuition.

The racial wealth gap can be directly attributed to a confluence of discriminatory policies going back to the New Deal and extended through the GI bill, the mortgage-interest tax deduction and other real-estate tax deductions, and discrimination embedded in higher education, labor markets, and housing policies—all of which helped build the white American middle class while leaving other racial and ethnic groups behind. The Great Recession of 2007-2009 further deepened the divide, as black and Hispanic individuals received subprime loans at a rate much higher than white individuals with the same credit score and bore the brunt of the collapse.

While there is no single solution to address the racial wealth gap, overhauling the mortgage credit system, combating unemployment and mass incarceration, and ending discriminatory housing policies are places to start. What is clear is that market forces or individual determination alone cannot overcome the decades of barriers put in place by decades of discriminatory policies and lack of equal enforcement of the law.