Measuring U.S. economic growth

Each quarter, the U.S. Bureau of Economic Analysis releases its Gross Domestic Product report, which measures the value of goods and services produced in the United States. These numbers drive our national conversation about economic growth, yet they provide precious little information about the well-being of most Americans. The solution is to add a distributional component to our System of National Accounts that would tell policymakers and the general public not only the average growth of the economy, but would also report income growth for the rich, poor, and middle class.

Download FileMeasuring U.S. economic growth

In recent decades, income inequality in the United States has been rising, and larger shares of economic growth have flowed to the very top of the income distribution—the most wealthy. From 1980 to 2014, pretax income growth for the top 1 percent of all earners was 204 percent in the United States, far above the national average of 61 percent. Over the same time period, pretax incomes for the bottom 50 percent of individuals grew by just 1 percent.1

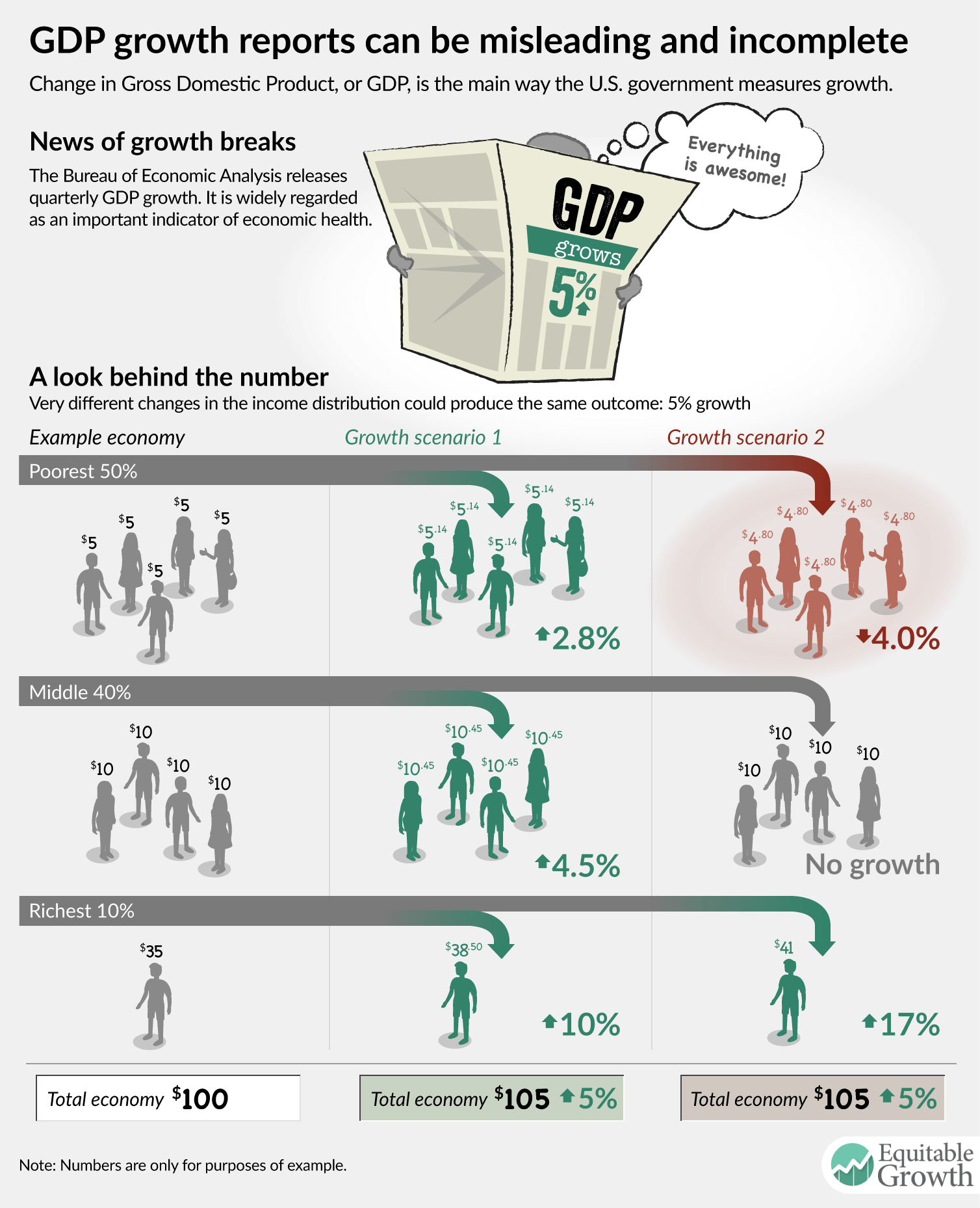

Therefore, the official GDP growth statistic may bear little resemblance to the experience of most Americans. Because it is a report of average growth across everyone in the United States, as incomes at the very top skyrocket, they drag the average up with them, making GDP growth less and less representative. (See Figure 1.)

Figure 1

Better understanding how economic growth in the United States is shared among income groups, geographic regions, and demographic groups will have a significant and lasting impact on how policymakers and economists alike gauge economic progress and evaluate policy.

Key takeaways

- The measurement of GDP has fostered a national fixation on “growing the pie” that ignores how growth is distributed. That conventional wisdom has become antiquated, as more and more of the nation’s growth has accrued to the top 1 percent.

- Policymakers interested in combatting rising income inequality cannot evaluate the effectiveness of their policies without a consistent, high-quality measure of how economic growth is distributed.

- Existing statistics on inequality and the distribution of economic gains produced by the federal government do not account for all income, vastly underestimate the income of top earners, or are not given the level of attention received by other major economic statistical products.

- A distributional component could be added to the National Income and Product Accounts, at least in part. The United States could include many of the most desirable features of such a system, although some others may require investments in new statistical infrastructure.

To learn more

“Disaggregating growth: Who prospers when the economy grows”

By Heather Boushey and Austin Clemens

March 2018

“What if we took equity into account when measuring economic growth?”

By Heather Boushey and Austin Clemens

November 2017

“Here’s why you should interpret tomorrow’s GDP growth estimate skeptically”

By Austin Clemens

October 2017

“Improving the measurement and understanding of economic equality in the United States”

By Robert Solow

July 2017

“Americans’ feelings about the U.S. economy make sense”

By Heather Boushey

February 2017

“The once and future measurement of economic inequality in the United States”

By Austin Clemens

March 2017

“Distributional National Accounts and measuring 21st century growth”

By Heather Boushey

December 2016

End Notes

1. Thomas Piketty, Emmanuel Saez, and Gabriel Zucman, “Distributional National Accounts: Methods and Estimates for the United States,” Quarterly Journal of Economics (2018, forthcoming).